In a previous post titled "Platinum Outshines Palladium, Yet Both Offer Opportunity," I discussed potential opportunities for investors to buy into these two white metals.

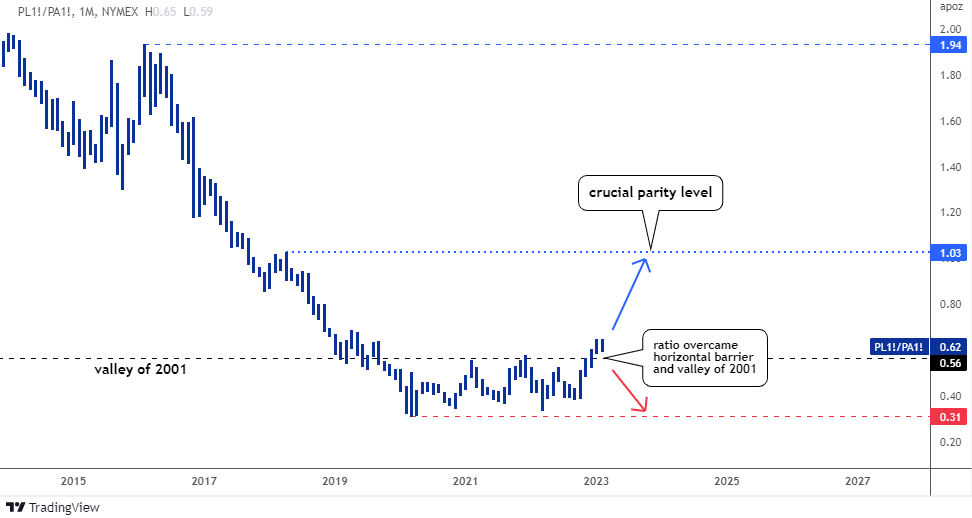

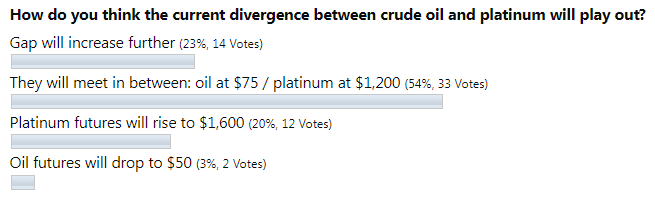

The fact that platinum was chosen over palladium by three out of five readers in the ballot was not surprising. The platinum/palladium ratio and the chart setup for platinum futures were both supportive of the title's argument.

Let’s check on what has changed in one month. We'll start with platinum futures.

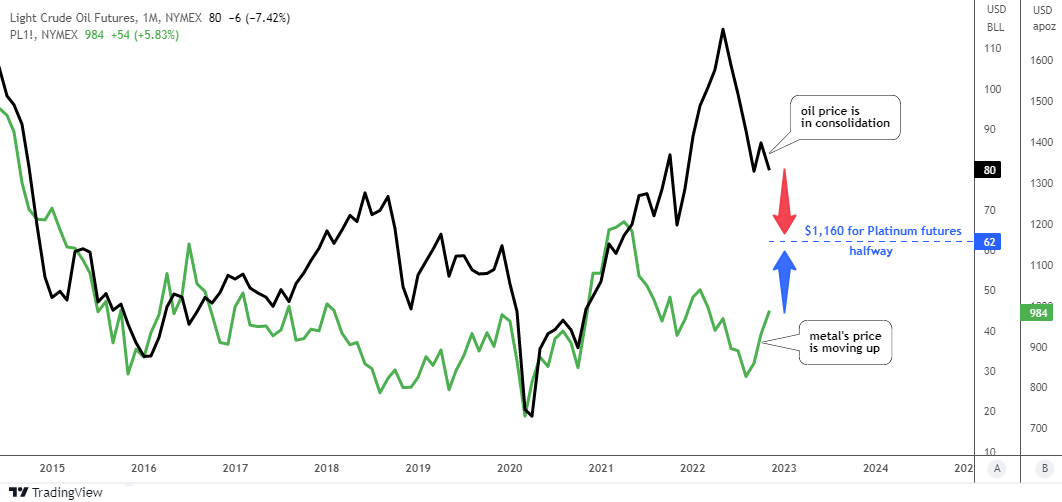

The price of platinum futures has been following my predetermined path with remarkable accuracy. I kept the previous annotations for you to see it.

The forecast that the price would reverse around the "golden cut" 61.8% Fibonacci retracement area proved to be successful, as the price tested the support twice and held. Subsequently, the futures price mimicked the trajectory of the blue zigzag, moving to the upside. Continue reading "Platinum Cleared The "Launch Pad" For Palladium"