It's been just a little over a year since we had our first major buy signal for the S&P 500 at 888.70 on 5/4/09. Since that time, the S&P 500 has climbed approximately 61.8% from the lows that were seen in early March of '09 and the highs that were seen in October of '07.

It's been just a little over a year since we had our first major buy signal for the S&P 500 at 888.70 on 5/4/09. Since that time, the S&P 500 has climbed approximately 61.8% from the lows that were seen in early March of '09 and the highs that were seen in October of '07.

We take our "Trade Triangle" technology very seriously and this signal today (5/25) at 1044.50 is our first major sell signal since 7/1/08 at 1,272.00 and should not be ignored.

There are a whole host of problems that are coming due around the world that will have negative consequences for the equity markets. The problems in Greece and Europe are well known and are likely to continue for the balance of the year. This is going to have a negative impact on markets in general. Continue reading "One year later, reality sets in"

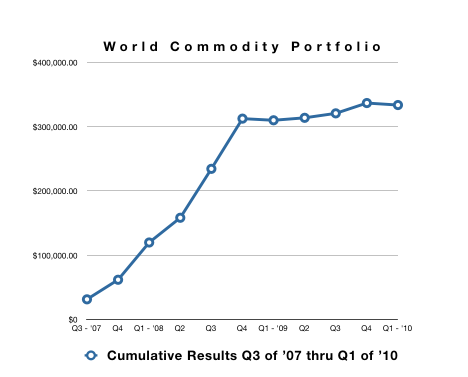

The first quarter of the year proved to be a challenging one for many traders outside of the equity markets. The "Perfect Portfolio" which tracks 4 markets was no exception. In the four ETF markets we track, the portfolio was equally split with winners in two markets and losers in two markets.

The first quarter of the year proved to be a challenging one for many traders outside of the equity markets. The "Perfect Portfolio" which tracks 4 markets was no exception. In the four ETF markets we track, the portfolio was equally split with winners in two markets and losers in two markets. We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.

We began Q1 with high hopes of keeping our winning streak alive, just as we had finished out the year on a very positive note with some strong gains in Q4 of 2009.