The prices of gold and silver remained between triggers last week as volatility left the market, and the “pulse” on the chart is hardly beating. It is time to challenge our bullish view, as it could be “too good to be true.”

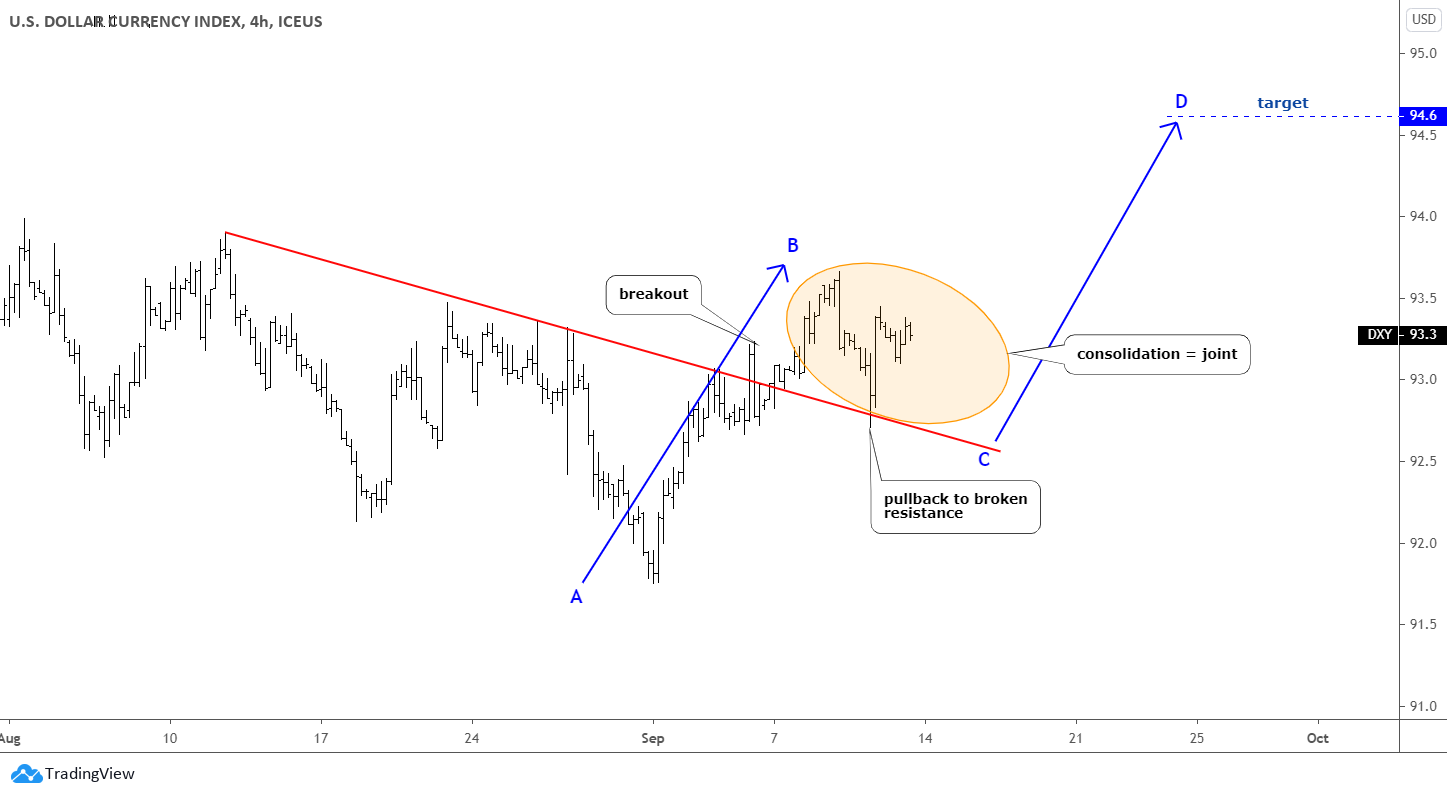

Let us imagine if the market is building a more complex correction and another downward move is underway. I put that scenario in the alternative charts for gold and silver below. Before we jump in precious metals, I would like to share with you an updated US dollar index (DXY) 4-hour chart.

The DXY goes very well with my expectations as the outlined structure keeps intact, and we got a larger consolidation here with a second leg down underway. It could dip even lower to retest the former resistance again in 92.4 area. That will cut the target for the pending CD segment either to 94.5 from the earlier aim of 94.6. Continue reading "Gold & Silver: Too Good To Be True?"