If you’ve been following along here over the past year, I won’t have to remind you that I have no problem telling it just like it is. And that includes the good news, and the bad news, about Bitcoin (BTC), cryptocurrencies in general, stocks, and the economy. You name it, and I try to be upfront and transparent.

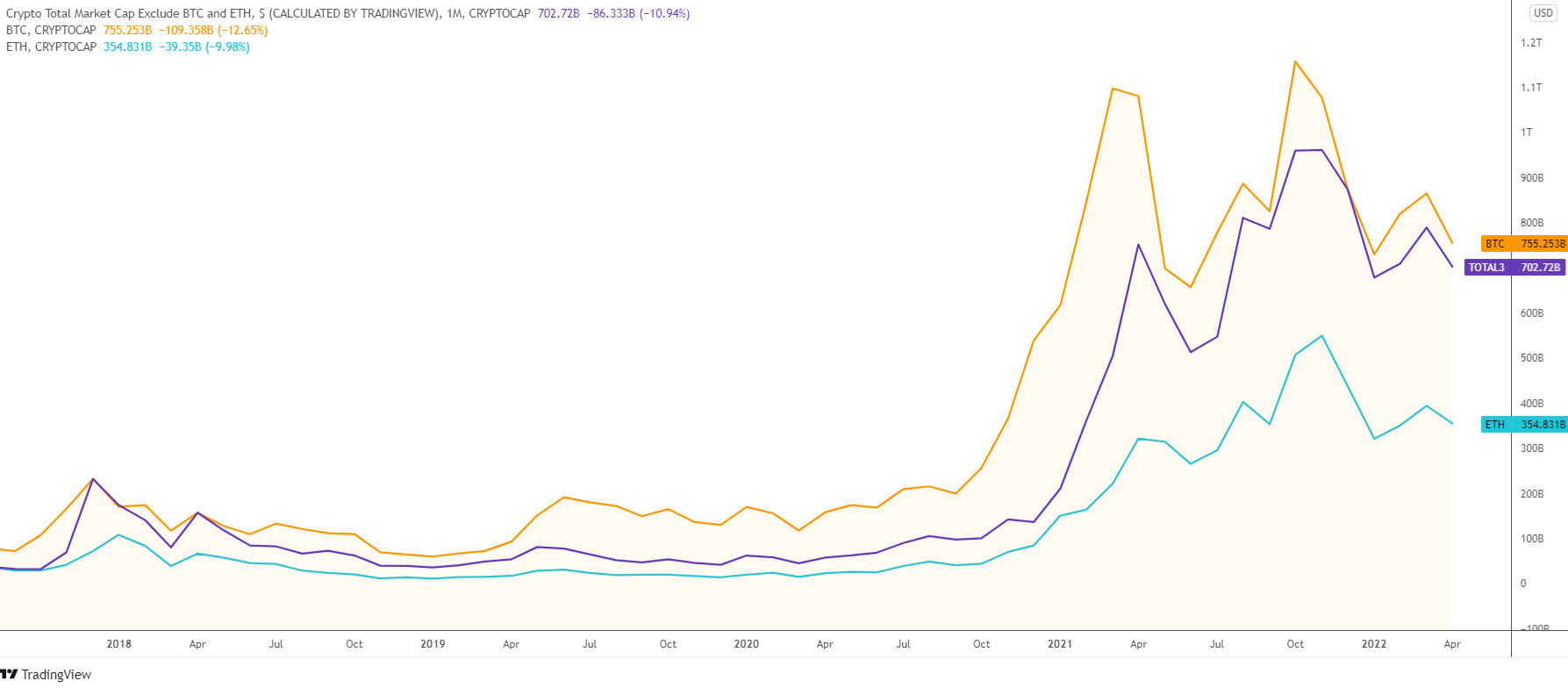

In fact, in last week’s post, I gave you the grisly details behind the sell-off in just about every asset class. I showed you how much every major stock index was down for the year in gory detail. I then showed you how Bitcoin was a member of that dubious club.

I also got under the hood of what I consider to be the biggest factor right now, which is hammering stocks and Bitcoin: Inflation.

The fact is inflation is at nosebleed levels, and it’s got just about everyone in a tizzy. And with good reason: Inflation eats away at incomes and makes products and services super-expensive. And since inflation now stands at multiple decade highs, you ignore it only at your own peril.

But as bad as inflation is, I have to remind you that down deep, what really makes investors nervous is not inflation itself but the tool of choice that gets used to fight it: Higher interest rates. Continue reading "What All The Recession Talk Really Means"