Last month in my post I warned you that the market for copper and Freeport-McMoRan Inc. (NYSE:FCX) entered the consolidation period, which meant that it was good to let the market drift lower and wait for better price opportunities. As you could see in the chart below patience indeed is a key to everything.

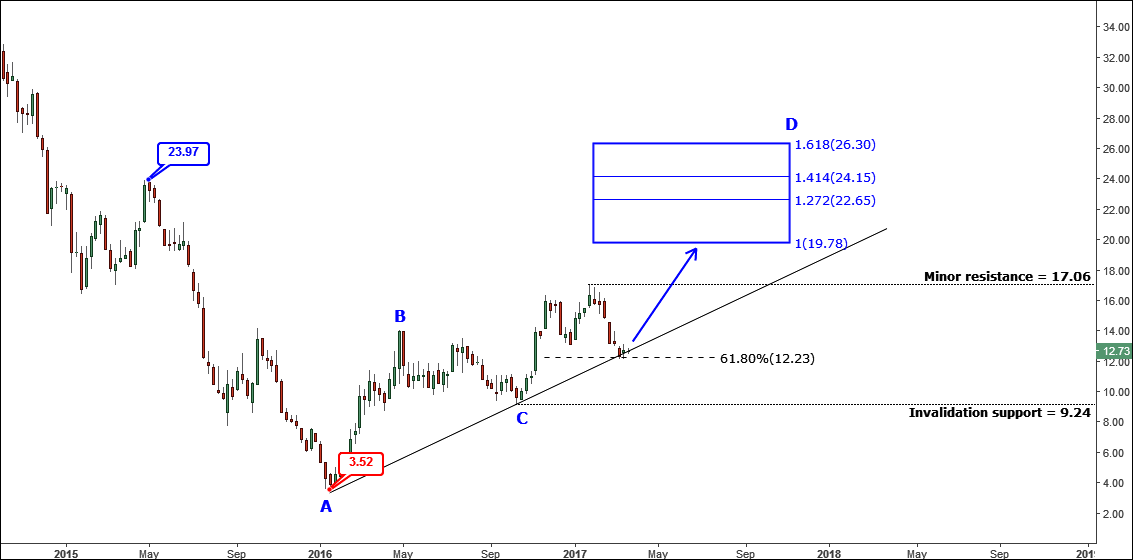

Chart 1. Freeport-McMoRan Weekly: Trendline Support

Chart courtesy of tradingview.com

The price lost almost a quarter for the past six weeks and touched the black trendline support, which stopped the drop and keeps the price above it for the third week already. The stock price already retraced to common the Fibonacci 61.8% level, which adds power to the black trendline support.

I labeled the first upmove from the start of 2016 as the AB segment. After that we can see the serious consolidation between the B and C points. I think we are about to start the second small leg within the large CD segment. The blue rectangle highlights the possible area where the price could reach. It starts from the $19.78 level where the CD=AB, then I added the rest of Fibonacci ratios with the 1.618 ratio at the top of the rectangle at the $26.3 mark. The 1.414 ratio at $24.15 mark almost coincides with the previous major top established in 2015 at $24 level. The first minor resistance is located at the previous top at the $17.06 mark.

The break and weekly close below the trend line would be the first alarming signal to buyers. The final invalidation occurs once the price breaks below the previous minor support at the $9.24 mark. The risk-reward ratio varies between the 1:2 and 1:4.

Below I added the comparison chart to show you the dynamics of FCX, another copper company and the copper itself to expand the scope of analysis.

Chart 2. 1-Year Comparison Chart Of Copper, Freeport-McMoRan And Southern Copper: FCX Is Wild

Chart courtesy of tradingview.com

In the chart above, I put together Freeport-McMoRan (blue), Southern Copper Corporation (red) and copper (black). As you can see for the past year SCCO beats all the rest with a 29% gain, FCX with an 18% gain could hardly pass the metal, which scored a 16% gain. One could notice the propensity of the Freeport-McMoRan to overshoot copper’s gains which could be used for one’s favor. Southern Copper has lower volatility and tracks the metal’s price with rare breakouts.

Southern Copper Corporation (NYSE:SCCO) has almost two folds larger market capitalization than FCX and one could prefer that company for this reason, although FCX has almost three times bigger assets than SCCO but almost the same equity (capital). To show you more data for these companies I added a separate valuation table below.

Table 1. Copper Companies Valuation

Freeport-McMoRan Inc. (NYSE:FCX) beats Southern Copper Corporation (NYSE:SCCO) in almost all absolute valuation figures, including Forward P/E, Price-To-Sales, Price-To-Book-value, Earnings-Per-Share this year and next year. SCCO has only one better relative number – its EPS next year is more than two times better than EPS for this year. Despite this SCCO has better price dynamics than FCX so far.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Slow continual growth with respect to market verses debt. The variables will Always be regulation pricing pressures and violatilty. I choose the measurable slow growth verses the speculation play, causes too much grey.