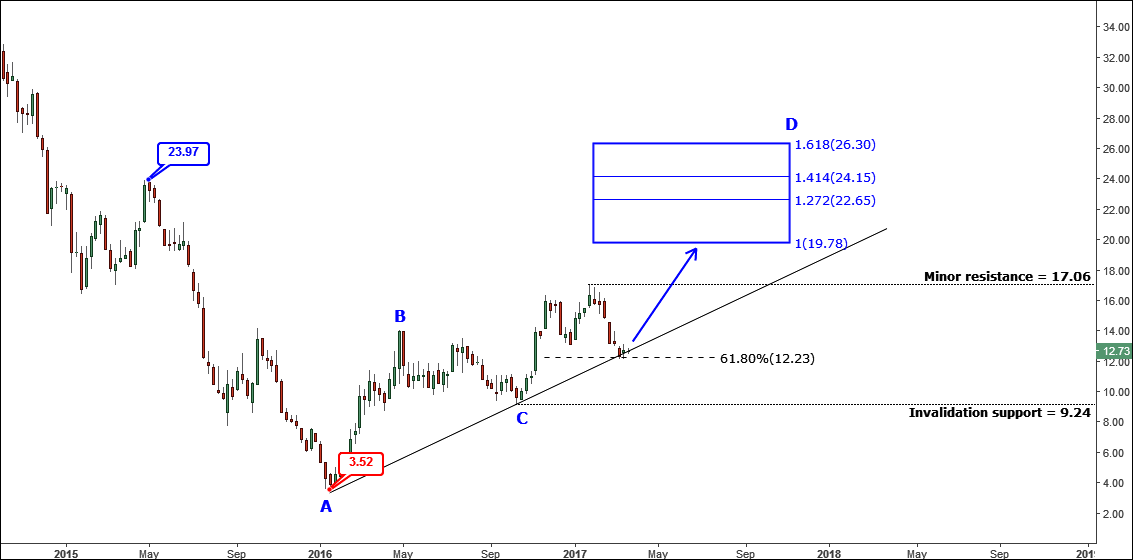

Last February I called for a long position in Freeport-McMoRan Inc. (NYSE:FCX) amid temporary weakness within a consolidation phase. Later on in March when the expected weakness reached support I posted an alert for you to catch the opportunity and set the target area with a $19.78-26.30 range. At the start of this month, the initial target at the $19.78 level was hit, producing a 55% profit for the year. My congratulations are to all who took the longs!

I also mentioned Southern Copper Corporation (NYSE:SCCO) for those who prefer larger market cap companies. That trade produced a good profit of almost 39% in the same period. However, it doesn’t compare to the 55% profit from FCX even though it set the new record high at the $50.90 breaking above the previous long-term top ($49.82).

Below are the poll results where you voted for these two stocks last March. Continue reading "Freeport-McMoRan's Breakout Hits The Target"