Dear readers, thank you for sharing a moment to leave your stocks preferences below my previous post! Some of you even trusted me to analyze some high-tech stocks, I am honored, and maybe one day I will find time to do it. Silver stocks and gold stocks are in your focus as I understood. This post is dedicated to the silver stocks.

This February I analyzed the top silver stocks (by market cap) and brought you some interesting and potentially profitable disparity that I found on the chart. After the comparison chart I asked you to pick your favorite stock among the top five and below is the graph of the voting results.

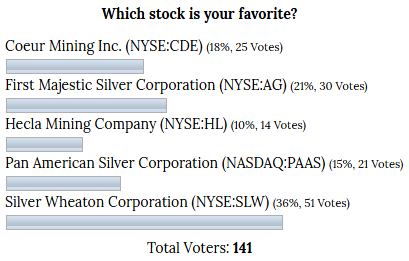

Graph 1. February 2017 Stock Pick Voting Results

The majority of you chose Silver Wheaton Corp. (NYSE:SLW) as your favorite. First Majestic Silver Corporation (NYSE:AG) ranked second and Coeur Mining Inc. (NYSE:CDE) was the third. Let’s see how those stocks behaved after the vote in the chart below that covers the period from the vote till now.

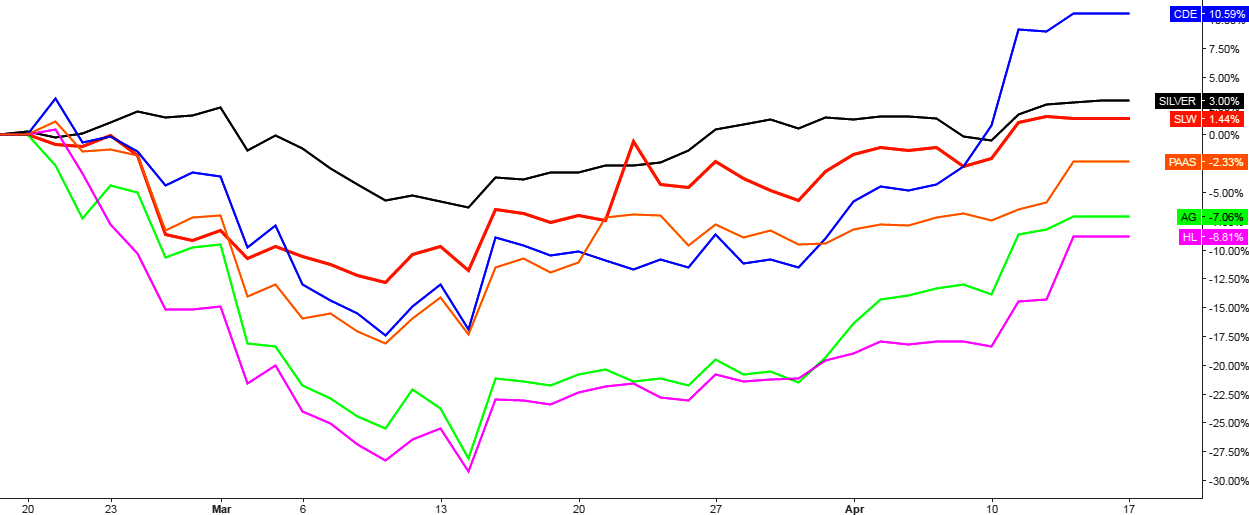

Chart 2. Top Silver Stocks (17th February 2017 till now): The Fallen Angel Took His Chance To Fly Up

Chart courtesy of tradingview.com

Only one stock could beat silver’s performance for the previous two months. I had proposed in my previous post that this stock should have a higher price despite the hard sell-off that occurred amid softer than expected earnings as it had better overall fundamentals compared to its rivals. This company is Coeur Mining Inc. (NYSE:CDE) and its stock scored an awesome 10.6% increase the past two months at the current $9.8 price level. The target was set at the $11 mark (silver price was $18) so we have more room to the upside then. And most of you were right to vote for the buy/hold option for CDE as shown in the graph below. Thank you for supporting my assumptions!

Graph 3. CDE Voting Results

Your favorite pick, Silver Wheaton Corp. (NYSE:SLW) showed the sluggish but still positive gain at +1.4% ranking second. Any positive score is still a profit and it warms your heart, which can’t be said about the other stocks.

This result shows that disparities in comparison charts should be examined and if there is no significant fundamentals (including underlying asset’s behavior) or news pushing the stock price below or above the industry dynamics then we could turn those mismatches to our profit in the short-term period.

Indeed, these short-term results shouldn’t be used to change your long-term preferences and I prepared another comparison chart for you to see more perspective.

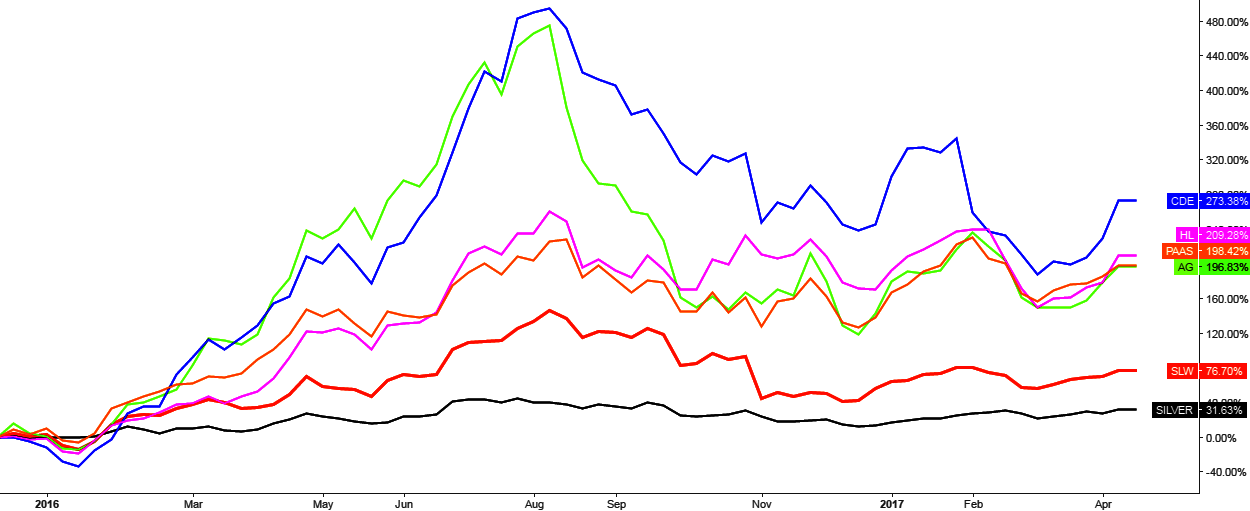

Chart 4. Top Silver Stocks (14th December 2015 till now): Not All Snakes Are Cobras

Chart courtesy of tradingview.com

The chart above starts from the major low in the silver price established on 14th of December 2015 as we are going back to the basics. And we see here again that the favorite stock failed to deliver the same triple-digit gains as its rivals. That’s the reason why I put the slogan for this chart “Not-All-Snakes-Are-Cobras” as you can see that the peers are currently in a “Cobra’s Attack” pose (especially CDE) while SLW is showing a comparatively flat trend.

CDE still possesses the top ranking for gains for more than a year in spite of a heavy loss from August through October of last year and this February. The sound fundamentals described in my previous post underpin its rocket growth so far.

This chart again, didn’t help to reveal the reason of Silver Wheaton’s top position. I tried the other way and I think I found the answer, finally!

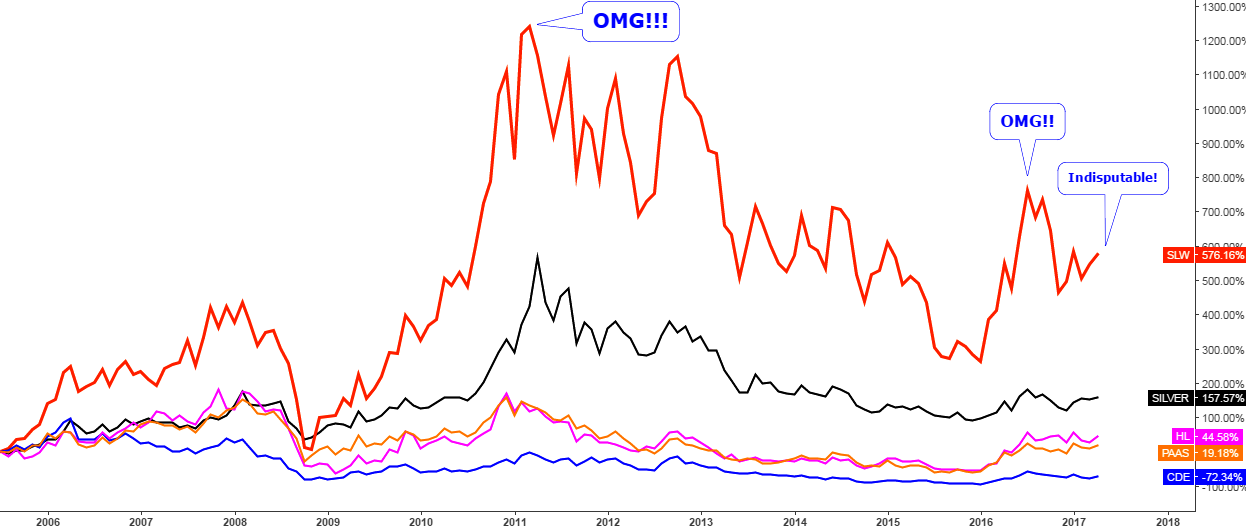

Chart 5. Top Silver Stocks (July 2005 till now): Marathon Champion!

Chart courtesy of tradingview.com

I think this is the best chart for Silver Wheaton’s stock. SLW fans should print it in color and hang it in their hall of fame. This perspective clearly shows why your top choice is Silver Wheaton, especially if you bought it in 2005 when this stock started on the NYSE at $3.10 or in 2008 when a new low was established at $2.51. Here are our triple-digit and even quadruple-digit returns, which we couldn’t find in the charts above. SLW is the indisputable champion.

Our famed CDE here is an Anti-Hero with a double-digit negative return. Other stocks couldn’t beat the metal during that period, which scored a triple-digit gain of 158%.

As we can conclude from all charts above – the base/starting date or timing is the most important factor for an investor and trader. And we should always choose the time frame, which suits us the most based on our individual character.

Below is the current view for the SLW as a bonus track for you.

Chart 6. Silver Wheaton (NYSE:SLW) Daily: Breakup!

Chart courtesy of tradingview.com

SLW follows the silver price very well especially during the metal’s weakness. When the metal’s price rises the stock is lagging behind, almost as if it waits to see if the metal would start to fall back taking time for confirmation. And if the price of silver finally drops, then SLW would meet it at the convergence point as shown in the chart above, where the silver price is a background (blue, left scale) for the SLW price.

The main event detected on the chart is the breakup of the black trendline resistance that occurred last week. This is an important positive signal for the stock. The metal price corresponds to the $24.5 level in SLW. As I said above, this is not a guaranteed move as the stock price could just wait for the consolidation of the metal in some convergence point nearby.

There are two red alerts that are highlighted in the chart. The RSI indicator is shaping a Bearish Divergence as it has a lower peak vs. a higher top on the price chart; it’s not so obvious yet, but is worth noting. And the second one is the volume decrease which is not a price supporting factor. After each breakout we shouldn’t rule out the pullback to the broken trendline as highlighted in the chart above.

Here are some strong points of this stock. Silver Wheaton Corp. (NYSE:SLW) is a big company with the largest market cap and assets among mentioned in this post. It has an industry average or above average financial performance indicators. It beats the rivals in terms of dividend yield with profitability 1.28% as others show 0.17-0.53% yield or pay nothing at all. This dividend yield is not brilliant overall, but it is still pleasant with the possible bonus of growing stock price as if you buy a bond with a geopolitical risk protection.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.