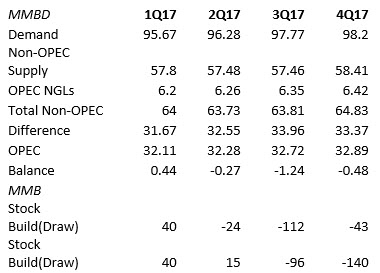

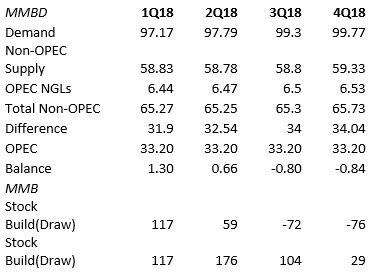

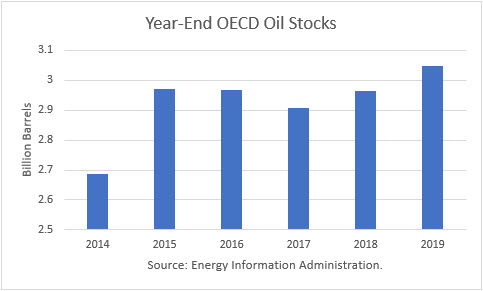

OPEC released its Monthly Oil Market Report (MOMR) for January, and its projections for 2018 imply a 29 million barrel global stock build, in contrast to 140 million barrel draw it estimated for 2017. As a result, it will not clear the glut, which OPEC estimates to be at 133 million barrels, at the end of November, based on the “latest five-year average.”

In 2017, OPEC production averaged about 32.5 million barrels per day (mbd), adjusting for the change in OPEC membership (i.e., with Indonesia’s 740,000 b/d).

In 2018, I have assumed OPEC production averages 33.2 mmbd, which is OPEC’s forecast (December) of its 2018 production. However, OPEC production averaged 32.416 mmbd in December.

OPEC projections imply that global stocks will build much more quickly in the first half of 2018 than they did during the same period in 2017. And the stock draws in the second half of 2018 are expected to be smaller than they were in 2017.

Saudi energy minister Khalid al-Falih and Russian oil minister Alexander Novak admitted in an interview that the glut might not clear during 2018. As a result, the two countries may continue to “cooperate” during 2019. They did not define whether the so-called “cuts” would continue. New data for 2017 show that OPEC and Russian oil production actually rose in 2017 compared to 2016.

While the interview was clearly intended to “talk up” the market, it was the first time the two ministers admitted that the glut may not clear in 2018. Initially, they had predicted the glut would clear by June 2017. In May, they predicted it would ease by end-2017. Now, they are talking about 2019.

Regarding OPEC’s 5-year average calculation, OPEC is now using the 2012-2016 base period, even though the glut started to develop in 2014, and so elevated levels are included. By this methodology, stocks could remain at their glutted levels and be at their five-year average target in 2019, using the 2014-2018 base period. Previously, OPEC used the five years leading up to the glut in its calculation.

IAE and EIA

The International Energy Agency (IAE) again reported in its January outlook that global inventories would remain stranded at current levels, adjusting for seasonal changes. It predicted that US shale production growth would be “explosive.”

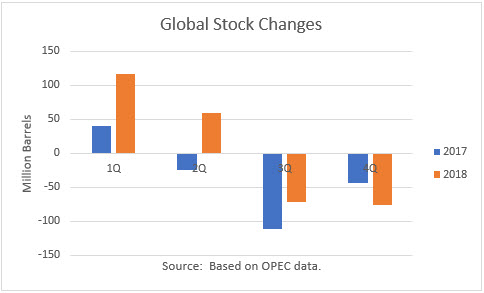

The Energy Information Administration (EIA) is projecting that global OECD stocks will end 2018 with 56 million barrels more than at end-2017. Furthermore, it projects 2019 stocks will rise another 85 million barrels to end at 3.049 billion. That figure is higher than ending levels of 2014 through 2017.

Conclusions

According to all three agencies, OPEC, IEA and EIA, there is no end in sight to the oil glut. Oil prices have been supported by a seasonal stock draw in the U.S., in particular. But that draw was, in part, an optical illusion. America exported part of its glut to non-US OECD countries, and their stocks rose by 46 million barrels during 2017. If first quarter 2018 projections are correct, there is a sizeable seasonal stock build coming in the weeks and months ahead, and the oil ministers will have to wait until 2019 before claiming victory in returning stocks “to the latest 5-year average.”

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

As an oil producer, the only price I care about is the price I get when I sell oil. Projections from the alphabet agencies mean nothing, because they all lie to suit there own ends. These are the significant factors that I know about: 1) the field price is determined by the futures market, and it is about $9 below futures, 2) no real oil is traded on the futures market; as far as I know, there are no deliveries, 3) no market analyst I know of has ever produced a barrel of oil.

So, for the entire year of 2018, where total demand for the year will be something over 36 BILLION barrels, you're going to make a case that a 29 million barrel build (if indeed that does happen, other say it won't), which would be 0.0008 of that total yearly oil demand, constitutes a glut?! Or even that 133 million barrels of global inventory over the "glorious 5-year average" ( 0.0037 of total yearly demand) constitutes a "glut"?! Wow!

As for the 3+ billion barrels of OECD inventory, that's how much oil it takes to "prime the pump" so that the system can spit out 100 million barrels of oil, EVERY DAY(!), into the marketplace. Sheesh!

I used to come here to read the comments on your pieces, not anymore, because there aren't any, good job on the site "upgrade" you should have left it the way it was. Companies nowadays are too focused on "new" customers while totally alienating their long time loyal customer base.