Crude oil production in Iran had reached 3.84 million barrels per day (mmbd) in the period following the lifting of sanctions by the Obama Administration. But following President Trump’s announcement in May 2018 that the U.S. would re-impose sanctions in November, demand for Iranian crude dropped to 3.7 mmbd by October. In November, the Trump Administration allowed limited waivers to the sanctions to eight countries, but Iranian production dropped by another 700,000 b/d by March.

The waivers were designed to terminate on May 2nd, but Secretary of State Mike Pompeo announced April 22nd that the waivers would not be extended. "This decision is intended to bring Iran's oil exports to zero, denying the regime its principal source of revenue," the White House said in a statement.

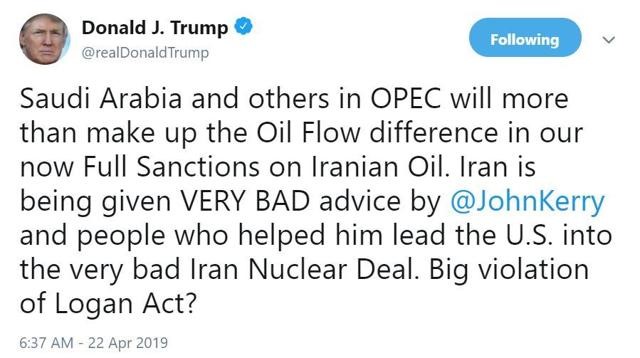

According to the International Energy Agency (IEA), Iran’s exports of crude and condensates are running about 1.1 mmbd in April. President Trump tweeted Saudi Arabia and others in OPEC had assured him that they would make up the impact of any decline in Iran’s exports:

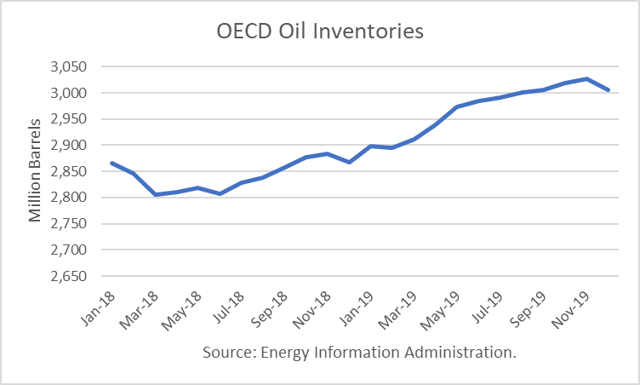

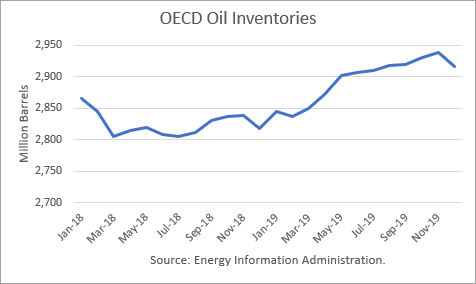

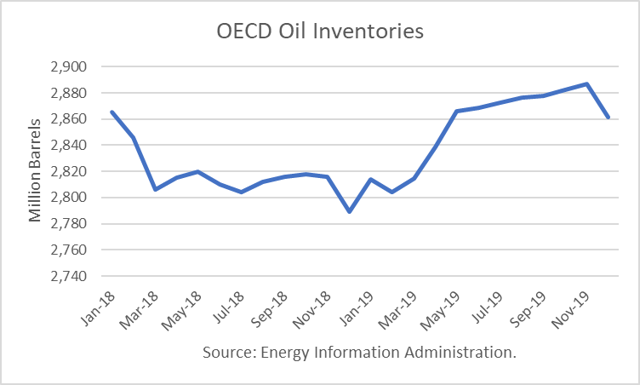

In the months leading up to last November, KSA had increased its output to 11.1 mmbd, at the request of the White House, to ensure that oil supplies would be adequate once the Iranian sanctions took effect in November. But Trump’s granting of the waivers immediately created an oversupply in the global oil market, and oil prices collapsed as a result. Continue reading "Oil Market Readies For Iran Sanction Waivers, Round 2"