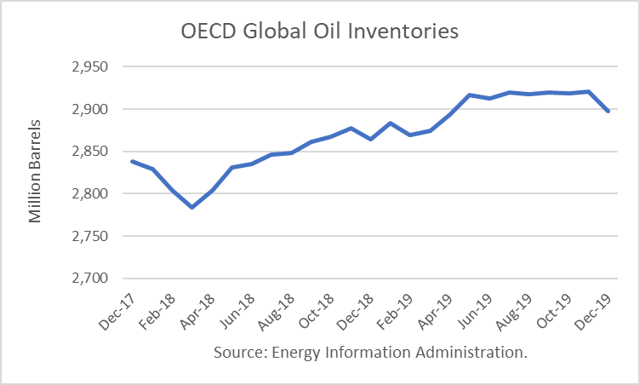

According to the Energy Information Administration (EIA), world oil production will exceed demand for much of the balance of 2018, and therefore global OECD oil inventories are projected to rise. Specifically, the EIA estimates that OECD inventories bottomed at the end of March at 2.784 million barrels (mmb) and will rise by 80 mmb through year-end, up 26 mmb from December 2017. And its projections through 2019 show another net stock gain of 34 mmb to end the year at 2.898 mmb.

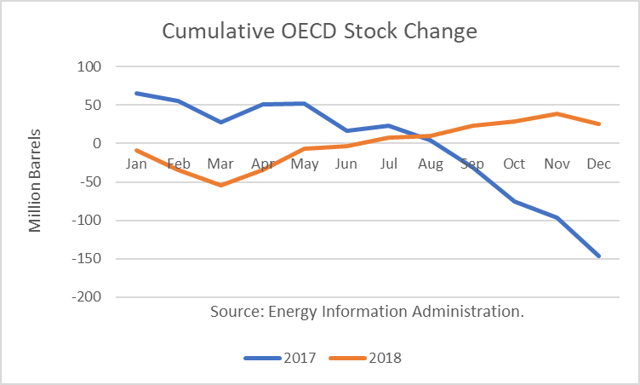

The DOE forecasts for 2018 and 2019 are based on dramatically different seasonal stock changes that occurred in 2017. OECD stocks fell by over 147 mmb from August through December, according to the latest estimates. But in 2018, it is predicting a net stock build over those same months.

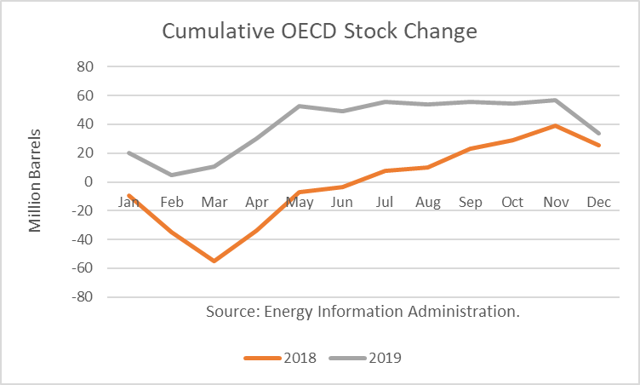

In 2019, it is forecasting a build similar to 2018, but without a first-quarter draw.

The DOE is projecting that world oil production will rise by 2.5 million barrels per day (mmbd) in 2018, a 3% gain. By contrast, it predicts that world demand will increase by 1.8 mmbd in 2018, a 2% rise. Approximately 2.0 mmbd of the rise in production will be from U.S. crude and liquids. It predicts a 300,000 b/d rise in Canada and a net 200,000 b/d gain in other OECD countries.

In March 2018, U.S. crude and liquids production was 1.7 mmbd higher than in March 2017, according to DOE estimates. And that gain does not reflect much of the $13/b rise year-over-year because much of it was in 1Q18, and there is about a 6-month time lag from a price increase to a production response.

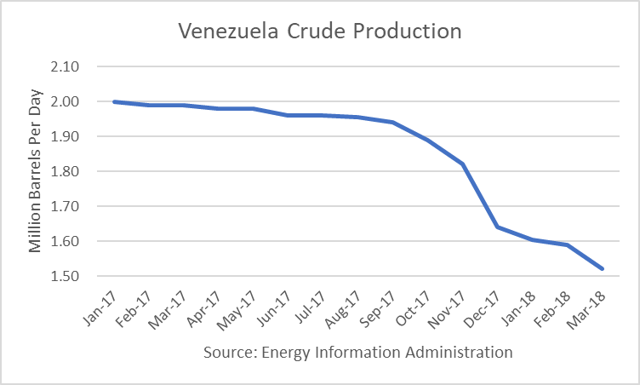

Therefore, I view the DOE supply and demand increases as likely, unless a trade war with China escalates and hurts economic growth. The other major risk is to production in Venezuela and possibly Iran. Venezuelan production fell to 1.52 mmbd in March.

The Trump Administration is likely to threaten Iran in May, but I think it will be to improve the terms of the nuclear deal, not to end it. Russia is investing in Iran’s oil sector and could purchase Iranian oil to re-sell, thereby allowing Iran to keep its production up. I view the risk of armed conflict to be minute, and if there were one, the Strategic Petroleum Reserves would be drawn up to make up any shortfall. The SPR has 665 million barrels and a drawdown capability of up to 4.0 mmbd, more than enough to completely replace Iran’s production. And President Trump has previously mentioned that he would like to draw down the SPR faster for budgetary reasons.

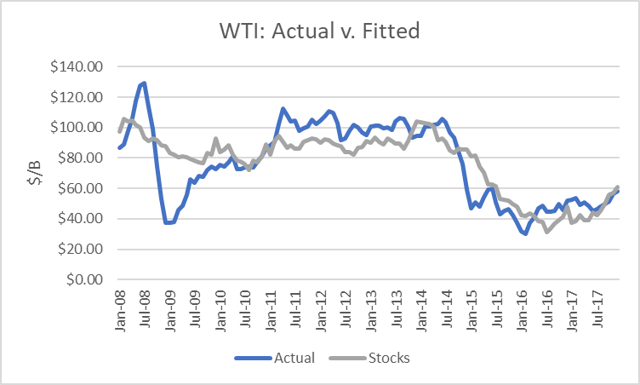

I previously discussed that I had run a regression between crude oil prices and OECD stocks from 2008 through 2017. The correlation is -79%.

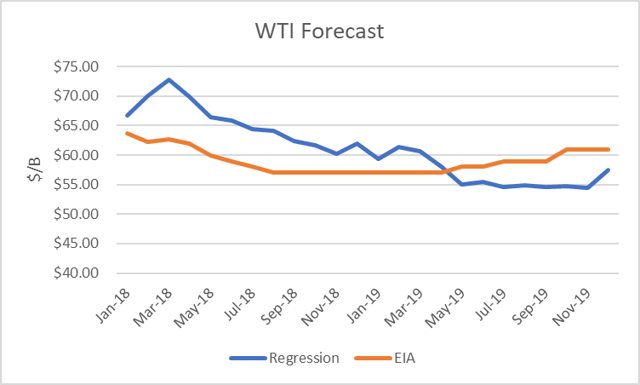

When I inserted EIA’s forecast for 2018 and 2019, I get the forward price curve as depicted below. I compare the price forecast from the regression to DOE’s WTI price forecast, and it shows that oil prices should have peaked in March. However, the DOE revised lower its estimates of OECD stocks beginning in December, and so the price forecast is higher than it was a month ago. It shows WTI gradually dropping to $60/b late in 2018.

The recent downward revision in DOE’s estimate of OECD stocks highlights the issue of estimation error. It is important to note that large errors can be present in their numbers.

Conclusions

To me, the most important trend is a larger increase in production expected v. demand. And as illustrated above, these trends may significantly alter the seasonal trends in 2018 v. 2017. But there are risks which can alter supply and demand from these trends, and so it is important to be vigilant.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.