Sometimes forecasts play out right after it you post on the Blog. This was true for the piece published in February when I wondered if “Another All-Time High Ahead For Palladium?”. The target set in the daily chart in the $2800 area was reached within 10 days as the metal burst into uncharted territory to book a hefty profit of 22% or $500.

To remind you, I suggested three possible scenarios of how the palladium price could go in February. The original chart is below to refresh your memory.

Chart courtesy of tradingview.com

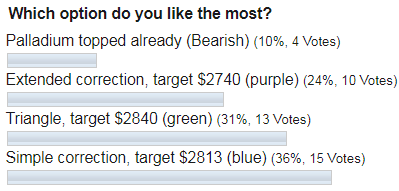

Below are your votes on the future of palladium.

The simple correction option (blue) has got the most votes and it played just perfectly as the price hit $2816 on the 27th of February. Again, the majority of you won the race! The AB/CD segmentation approach also showed exceptional accuracy as the actual top exceeded the target price by only $3.

Let me update the daily palladium futures chart for you as there are big changes that happened since the earlier post.

Chart courtesy of tradingview.com

The pandemic slashed prices across the commodities sector, and palladium was among them to lose half of the price, reaching a 9-month low at $1355 on the 16th of March. We hadn’t seen this level since last June. It was a panic liquidation as investors considered cash to be the safest place for the money. Just one week later, the price showed a V-turn reversal to the upside above $2300 when investors saw governments across the globe introducing stimulus to support a paralyzed economy. As always, we can see here how weak hands passed their holdings to “deep pockets” of whales at a cheap price.

The palladium futures price kept firm above $2000 for almost one month until the 21st of April when the outlook for the global economy was spoiled with the shocking drop of the Chinese economy as others considered to follow this trend.

That sharp bounce up has been retraced now as the price dipped back below $2000 on profit-taking. This pullback is quite deep as it already approached the 61.8% Fibonacci retracement area around $1742. It could be enough for the price to complete the retracement, which was contoured with orange trendlines.

I highlighted the segments of the current drop with red down arrows. Two of them have been booked already. The current zigzag brought the price above $2000 and then back below it. This could be another joint ahead of the 3rd drop, which could be tricky as it can smash all Fibonacci retracement levels to retrace the preceding move up fully.

The upper trendline offers immediate resistance. I highlighted with the pink ellipse the decision area where we can see either a breakout or a reversal of trendline resistance. The former could push the price higher to tag the former top of $2816. The latter could send it in the opposite direction where it could retest the former valley of $1355. Indeed, it’s a “fly or die” situation for palladium.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Only very wealthy collectors should be concerned about numismatic value. Palladium became "valuable" because of its use in catalytic converters. The auto market is close to death, so palladium won't have much fundamental value until that market comes back. I could be wrong, though, since the Fed may prop up its value along with a lot of other things.

Dear Carl M. Welch, thank you very much for regular comments as it enrich our knowledge.

The human life goes on and even more severe deseases couldn't stop it in the past.

The green cars are yet to replace conventional combustion engine autos. It means demand for catalyc converters are here for some time.

China's automarket is the largest in the world and it shows signs of rebound.

Palladium dropped in 3rd leg and bounced up. Watch 2076 trigger for all-time high retest.

Best regards, Aibek

Aibek

I'm not particularly worried about any one disease, although the black plague caused very large changes to European society. Of more concern is the collapse of civilizations. When the western Roman Empire collapsed, the population of Rome is estimated to have declined by over 90%. What happened to all those people? I don't think technical analysis in isolation can predict the future. Fundamental analysis of palladium demand is presently negative. A worse problem for palladium is that if a collapse occurs, physical gold and silver will resume their role as money. Most of the world's population knows what gold and silver are, but not palladium.

cmwelch

Hi Aibek, spot on analysis as always. I'm seeing 2823, not spectacular but okay.

Dear William,

Thank you for a warm feedback. Let’s live and see. Best regards, Aibek

Based on RSI , and the moving average below the 200 period , technically the price should move up , but fundamentally may sounds differently .

Dear Firas,

Thank you for stopping by to share your view.

Best regards, Aibek

I have one oz coins from the first and second year minted in the USA,what are these coins worth in their weight

Dear Stuart,

The US Mint sells 2019 one ounce palladium coin at $2650. https://catalog.usmint.gov/coins/precious-metal-coins/palladium/

This could be some kind of a guidance.

eBay sellers shows offer above $3000.

You could try your luck there as your earlier minted coins could have some additional numismatic value.

Best wishes, Aibek