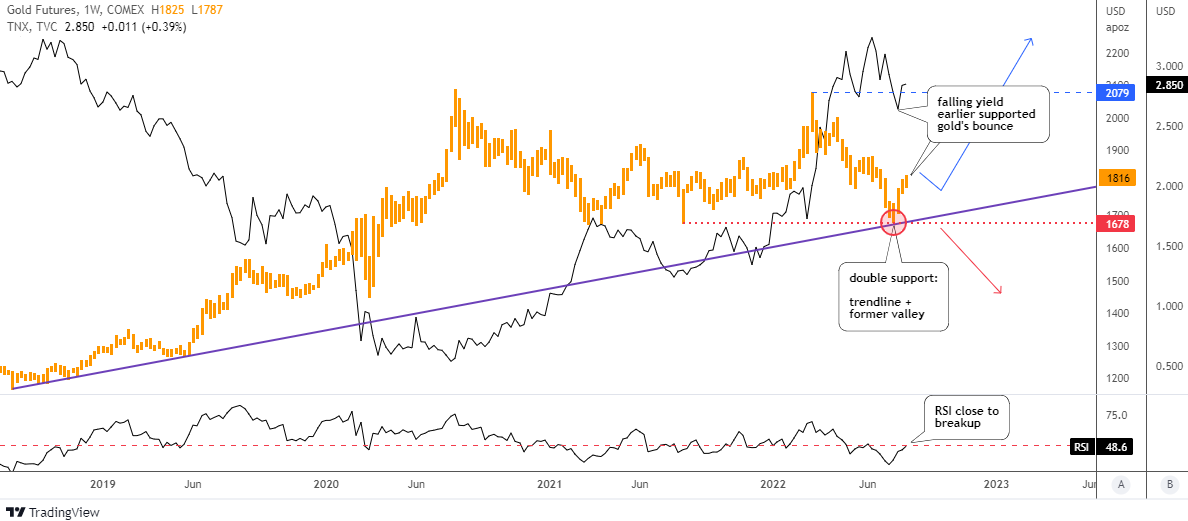

Back in June, I shared with you an alternative scenario for gold with a downside trigger on the trendline support.

I highlighted it with a purple color in the weekly gold futures chart below. This area is fortified with the red horizontal trendline based on the former valley of $1,678. Though, it’s a double support level.

It is amazing how accurately the price bounced off that strong support. The metal took its chance to jump to the upside amid the falling yield of 10-year U.S. government bonds (10Y).

The easing inflation data limits the hawkish expectations on the Fed rate hikes. Though, the 10Y’s advance has been paused as the market took some gains amid uncertainty.

However, the real interest rate is still strongly negative at -6%. The labor market shows vitality according to statistics. This leaves the room for the Fed to keep tightening until something breaks down.

The 10Y bounced off recently from 2.6% to 2.85% and nobody knows if it’s a continuation or a consolidation.

The gold market has been trapped with the whole uncertainty as it has built a large sideways consolidation since August 2020.

As long as the gold futures price keeps both above the former valley of $1,678 and the trendline support there is a chance to see the retest of the all-time high of $2,089.

For a bullish setup, the price should chart the minor correction that should not drop below the recent valley followed by the breakup of the most recent minor top as shown with the blue zigzag.

The RSI is close to the neutral area and it should move above the “waterline” of 50 to support a further advance of the price.

Such a large consolidation could bring a hope for gold bulls for a really big gain, as size matters! The longer it takes the market to digest the uncertainty, the stronger will be the new base for a new launch of the price to the upside.

Let us watch to see if the price will keep its grip above current support otherwise it would be a trap.

The silver chart was so bullish and so clean in my earlier update this March.

Much to the regret of silver bugs, the price couldn’t overcome the top of a junction at the confirmation level and then it rapidly lost its shine and a glory.

The drop in the second red leg down was sharper as was the Fed with a tightening. I relocated the labels of the red legs down as the structure got clearer over time. This is the tricky nature of corrections.

The silver futures have an ideal reaction on the chart. The volume profile has shown an amazingly accurate support in the second largest volume zone in the $18 area. The price bounced off right there. The 61.8% Fibonacci retracement is also here. The last valuable measurement is the size of red leg 2 compared to red leg 1 – the former is longer than the latter and that is a sign of sufficiency.

The most of you didn’t buy the target of $80 based on the giant Cup & Handle pattern and preferred the conservative targets within $40-$50 range.

Bulls should push the price above the nearest barrier of $22.6 first to overcome the volume gap pit where the silver futures price is now.

The RSI must break above the neutral level above 50. The final confirmation is located at the apex of the junction at $27.5. The new target based on a lower C point is located at $36.7.

The trap could evolve if the silver futures price drops below the most recent valley of $18.

Intelligent trades!

Aibek Burabayev

INO.com Contributor

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Hi

Hello there, thanks for reading!