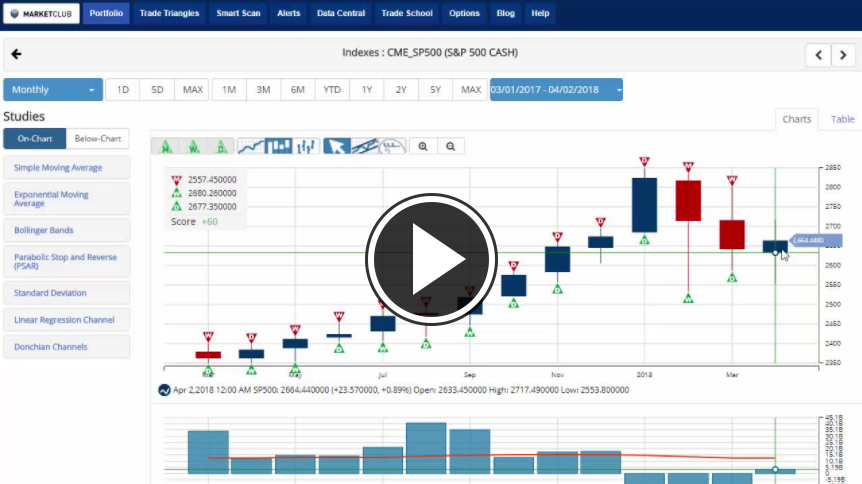

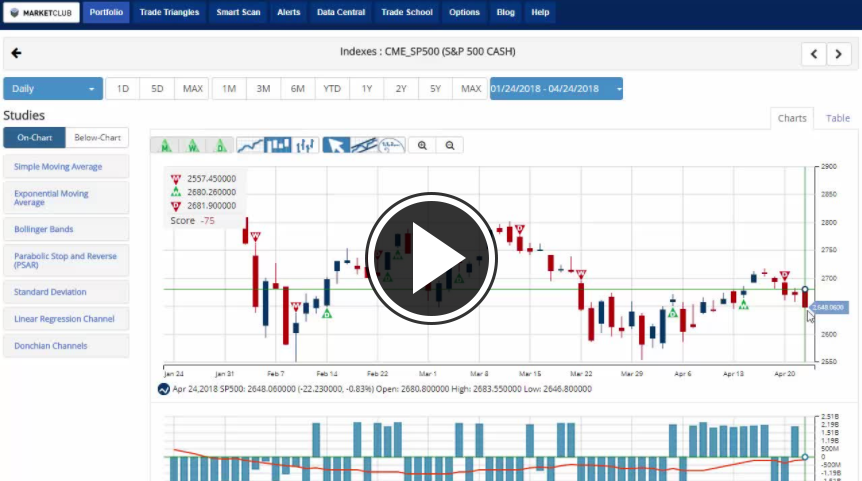

Hello traders everywhere. Although the stock market has slipped into the negative territory on the day all three indexes are looking to post a monthly gain for April. This will mark the first positive monthly gain in two months as volatility has taken a toll on the market over the last three months.

The S&P 500 is posting a monthly gain of +.75%; the DOW is looking to add slightly more to the bottom line with an increase of +.80%, in fact, the DOW hasn't had a losing April since April of 2005. The NASDAQ is posting the lowest monthly gain of +.18 as the tech sector has been under been under extreme pressure and volatility and with Apple (AAPL) earnings right around the corner it could get worse. All indications are that iPhone sells, although positive, are going to miss the mark as far as many analysts are concerned.

The U.S. dollar continues to make a comeback with a monthly gain of +1.98%. After posting a weekly loss last week, Crude oil is closing out the month on a strong note and posting a +6% gain on the month. Meanwhile gold is looking so brilliant as it posts a loss of -.69% on the month.

Bitcoin continues to make a comeback, and it is going to have an impressive monthly gain of +31% for April. If you can ride the wave, it certainly can pay dividends. Continue reading "Stocks Positive For Month Despite Weakness"