We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Gold Futures

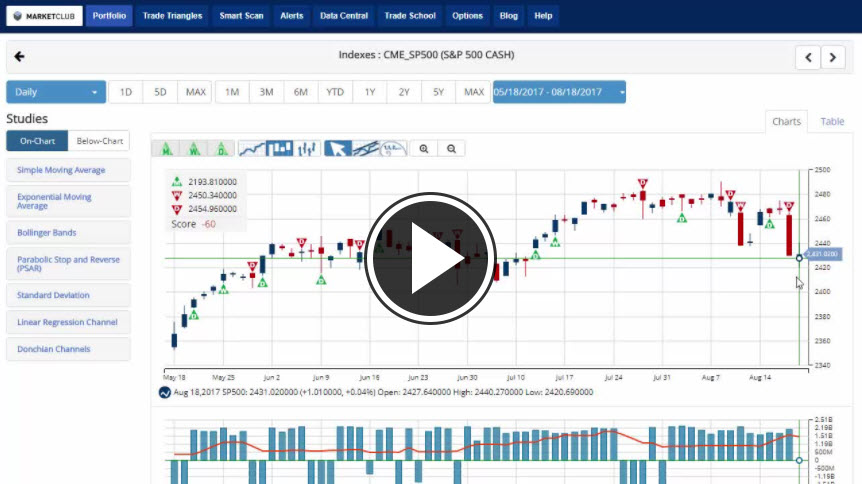

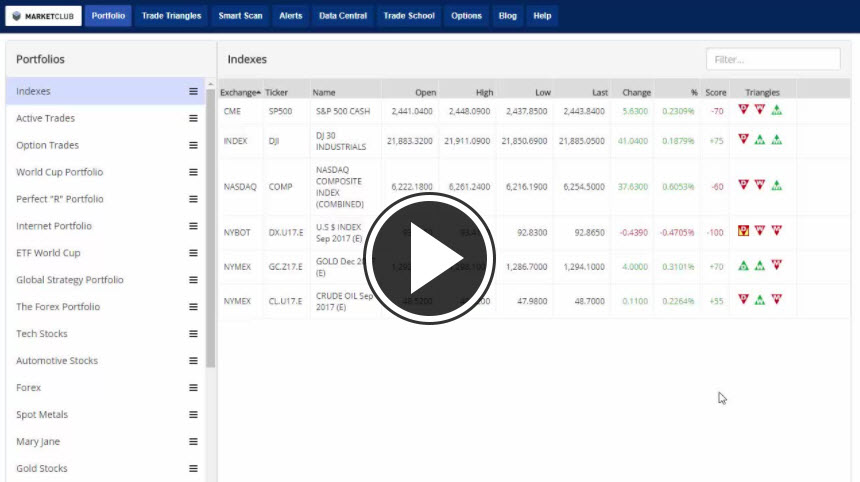

Gold futures in the December contract settled last Friday in New York at 1,294 while currently trading at 1,306 up about $12 for the trading week breaking the critical 1,300 level now looking to retest the April 17th high of 1,307 as this bullish trend remains intact in my opinion. I'm currently not involved in gold, however, if you do have a bullish position continue to place the stop loss under the 10-day low standing at 1,257. The chart structure will start to improve over the next couple of days, therefore, lowering the monetary risk as low-interest rates in the United States continue to help push up the precious metals here in the short-term. A major terrorist attack in Spain on Thursday is also helping push prices higher as the world is on alert for more attacks in the coming weeks. Prices are trading above their 20 and 100-day moving average telling you that this trend is to the upside with the next major level of resistance all the way at 1,350 which was touched in last November during the U.S election. At present my only precious metal recommendation is still a bullish position in the copper market, but it looks like higher prices are ahead across the board.

TREND: HIGHER

CHART STRUCTURE: IMPROVING

Continue reading "Weekly Futures Recap With Mike Seery"