Hello traders and MarketClub members everywhere, I trust you all had a great weekend. I am just waiting for the mid-terms to get over with so we can all get back to the markets. Is it just me or does it seem like these elections go on forever? We should know more on that front tomorrow evening. In the meantime, let's look at what the markets are actually doing today.

One of my morning rituals is to fix a nice cup of tea and scan through the Trade Triangles to see which stocks are showing new buy or sell signals for today. I have a certain criteria that I'm looking for when I'm searching for winning stocks. I look for stocks that are traded in the U.S. that average over 2 million shares a day. Why 2 million? It's really quite simple, I want to be in liquid markets, just in case I need to get out quickly. The advantage of trading in big liquid markets is that it's not too costly to enter or exit the position, whereas with thinly traded markets that can be a very expensive proposition.

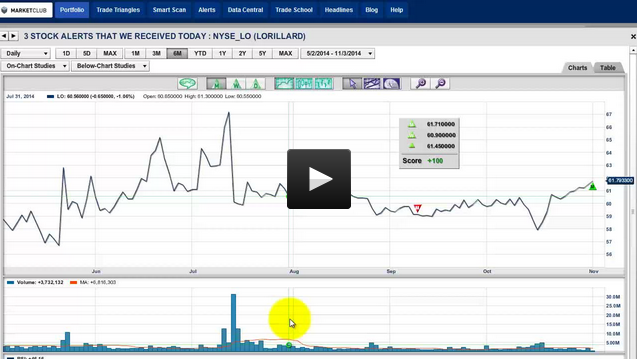

After finding several stocks that meet my criteria, I then look at the chart to see if it's something I want to act on. For example, if I see a very choppy chart that is giving signals all the time, I would consider that a less reliable signal.

Here are three stocks that our Trade Triangles picked out today that look interesting to me. Continue reading "3 Stocks You Need To Know About"