We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Gold Futures

Gold futures for the December contract sold off about $37 dollars from last Friday’s settlement of 1,287 as pessimism continues to grow in the precious metals as demand is at 4 year low as investors are selling gold ETF’s pushing prices lower and taking that money and putting it into the S&P 500 and NASDAQ which continue to make new highs once again today. Volatility in gold at this time is a 6 out of 10 meaning volatility can get much higher in my opinion as gold has been kind of grinding lower so if you’re looking to get short the gold market I would look at February put options or look at some bear put spreads for the month of April limiting your loss to what the premium costs as gold has entered into a bearish trend at this time. Gold looks weak right now and I do think prices will retest Continue reading "Weekly Futures Recap With Mike Seery" →

We’ve asked Michael Seery of

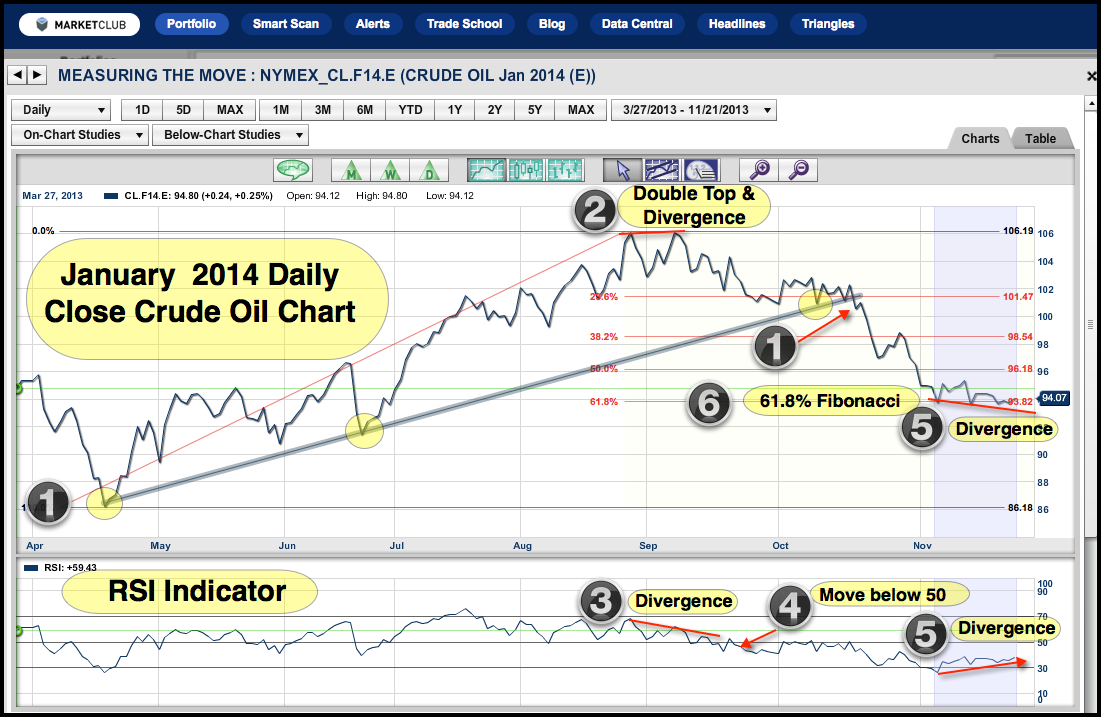

We’ve asked Michael Seery of  Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 22nd of November.

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 22nd of November.