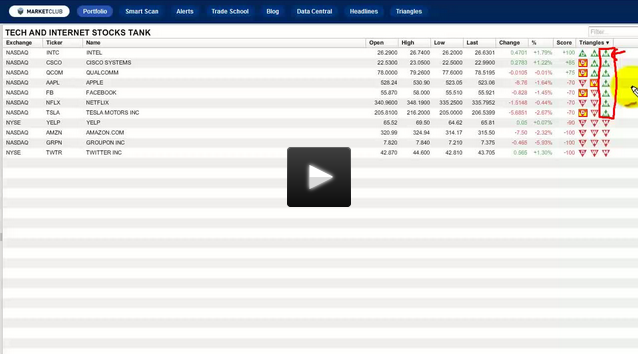

It is no secret that many tech/Internet stocks have been beaten up over the last several months and that action has pushed the NASDAQ index into a bear market phase. However, not all tech companies are in downtrends. I have three tech stocks that are in decidedly bullish trends and I will be discussing them today.

The first stock I will be looking at is Apple (NASDAQ:AAPL). It would seem that Apple had lost its way since Steve Jobs' passing, but yesterday’s closing over $600 puts a little bit more mojo into the stock of Apple. Now remember, this stock is going to split and there's all kinds of things going on with it. The important element for me is the general trend, which according to the Trade Triangles is positive.

The next stock I will be looking at is Cisco Systems (NASDAQ:CSCO). While not as sexy as Apple, this stock appears to have good upward momentum and looks to be moving higher from current levels. Continue reading "3 Trending Tech Stocks To Watch" →

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 22nd of November.

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Friday, the 22nd of November.