We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Gold Futures

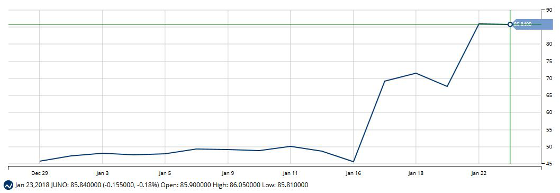

Gold futures settled last Friday in New York at 1,334 an ounce while currently trading at 1,334 unchanged for the trading week as the volatility certainly has increased as gold prices have rallied about $100 from their December 12th low of 1,238 as this remains in a bullish trend. I do not have any recommendations in the precious metals, but if you are long a futures contract, I would place the stop loss under the two-week low at 1,308 as the chart structure will also improve in next week's trade. The main reason for the recent rally is the fact that the U.S. dollar has hit a three year low which is definitely a fundamental bullish indicator towards gold and the precious metals as a whole. The next major level of resistance is the September 8th high of 1,365. I think prices will try to touch that level in the coming weeks ahead as it looks to me that the dollar will continue its bearish trend, therefore, supporting gold despite the fact that the U.S. stock market seems to hit an all-time high every day which used to be negative towards gold. But 2018 is a different story as the commodity markets will start to catch up to the high stock prices in my opinion as the U.S economy is growing for the 1st time in nearly ten years. Gold futures are trading above their 20 and 100-day moving average as clearly the trend is higher, but I will look at other markets with a better risk/reward scenario at present.

TREND: HIGHER

CHART STRUCTURE: IMPROVING

VOLATILITY: INCREASING

Continue reading "Weekly Futures Recap With Mike Seery" →