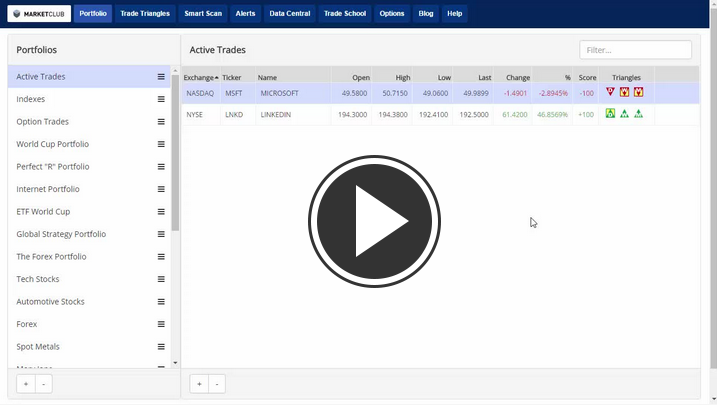

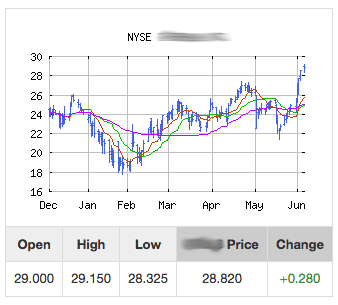

Hello MarketClub Members everywhere. LinkedIn Corp. (NYSE:LNKD) shares have soared as high as 49% this morning after Microsoft Corp. (NASDAQ:MSFT) announced that it's buying the company in a deal valued at $26.2 billion. This has caused Microsoft shares to slip a little over 2% as investors digest the news.

All eyes will be on the U.S. Federal Reserve meetings that start Tuesday as they discuss fiscal policy and the trajectory of the U.S. economy in the wake of a weak employment report for the month of May. Many investors will be watching closely on Wednesday for Fed Chair Janet Yellen's statement, as she has dropped numerous hints that the central bank would introduce another interest rate hike this summer. Still, the central bank is unlikely to raise interest rates further this week due to the disappointing jobs data and unimpressive first-quarter economic growth.

Key levels to watch this week: Continue reading "Stocks Fluctuate On LinkedIn News While The Fed Looms"