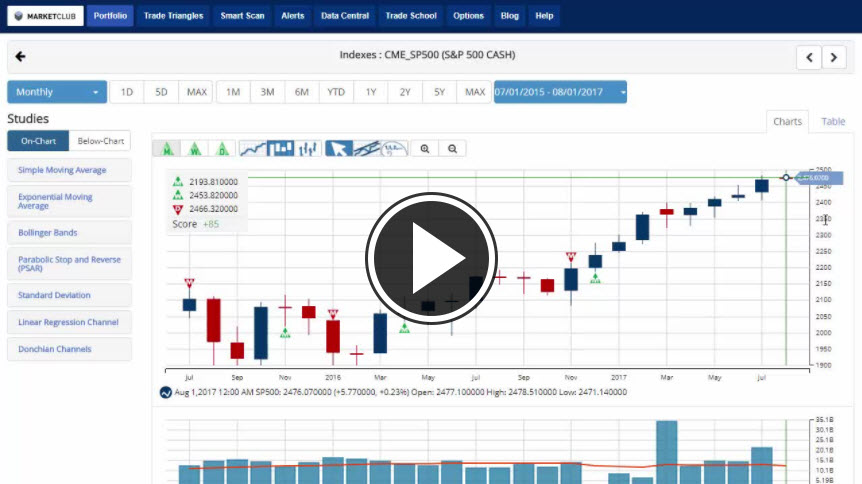

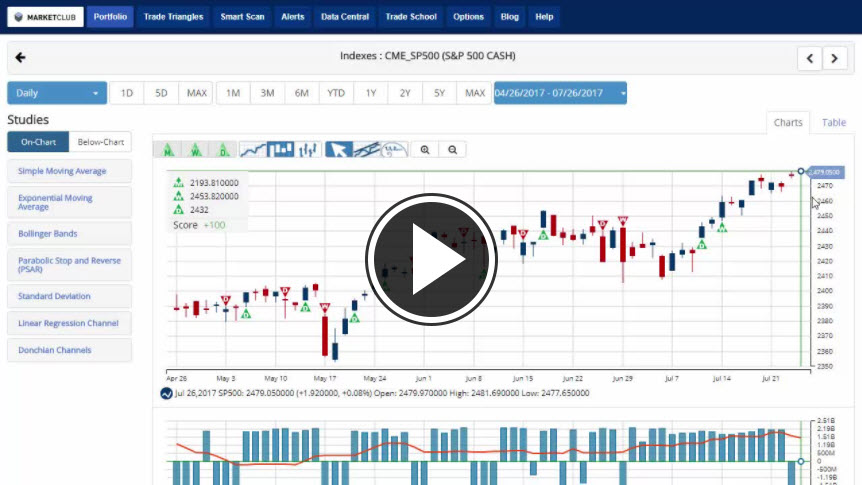

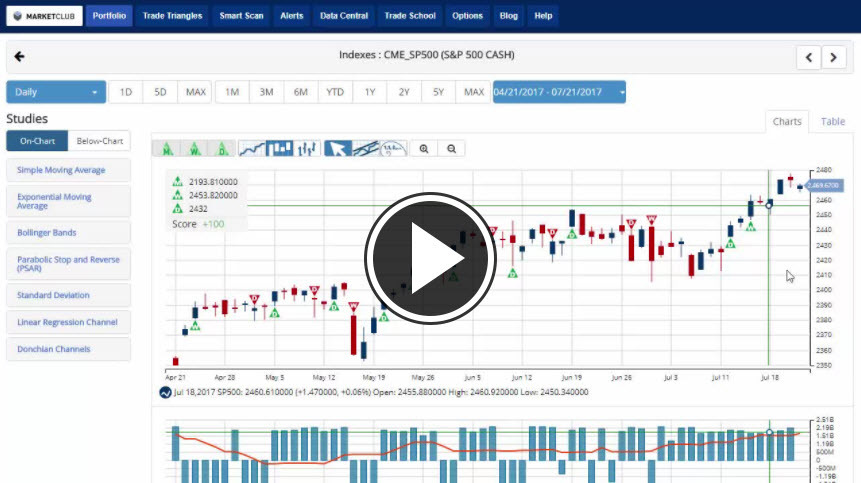

Hello traders everywhere. Hello Traders everywhere. The DOW is trading at all-time highs today and is within reach of 22,000. On the flip side, the U.S. Dollar Index continues to head lower after posting a fifth straight monthly loss in July. This is partly due to a manufacturing report that showed that last month fell short of expectations and data showed Americans' spending barely grew in June.

The yield on the 10-year Treasury notes slipped to 2.26% while crude oil retreated after topping $50 a barrel.

Key levels to watch this week: Continue reading "DOW Hits Record High"