Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Friday, the 1st of March.

Hello traders everywhere! Adam Hewison here, co-founder of MarketClub with your mid-day market update for Friday, the 1st of March.

In addition to the markets we normally report on, we will also be looking at the following markets using our Trade Triangle technology.

STOCK TO WATCH TODAY-DISH NETWORK (DISH)

Dish and broadcasters like CBS have been battling in court for months now, and it is all over the legality of the Hopper, a digital video recorder that allows users to automatically skip all prime-time network ads on television shows. OUCH!!! Continue reading "Today's Video Newsletter: SEQUESTRATION - Much ado about nothing and 3 stocks to exit right now!!"

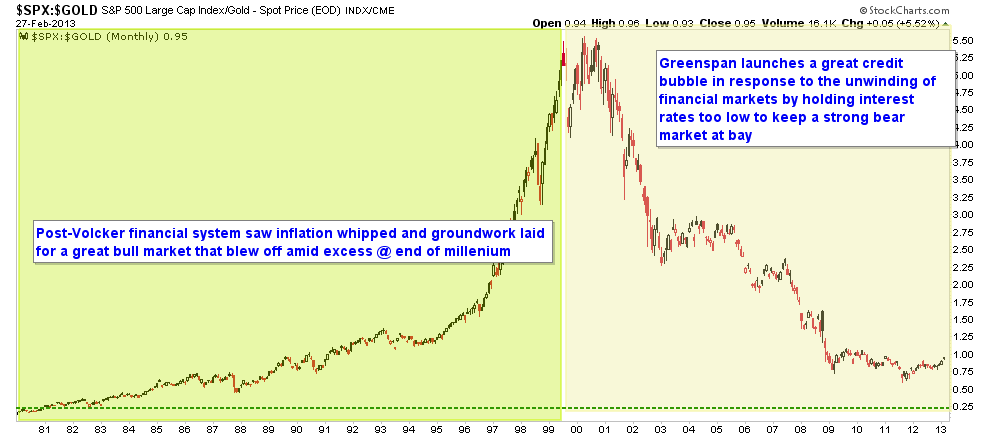

S&P 500 – Gold ratio monthly chart

S&P 500 – Gold ratio monthly chart