Over the past number of years, the best investments nearly all came out of the technology sector. We had terms like the FANNG stocks coined, we were told value-investing was dead, and year after year, the stable dividend-paying stocks just slowly trailed behind high-flying technology companies.

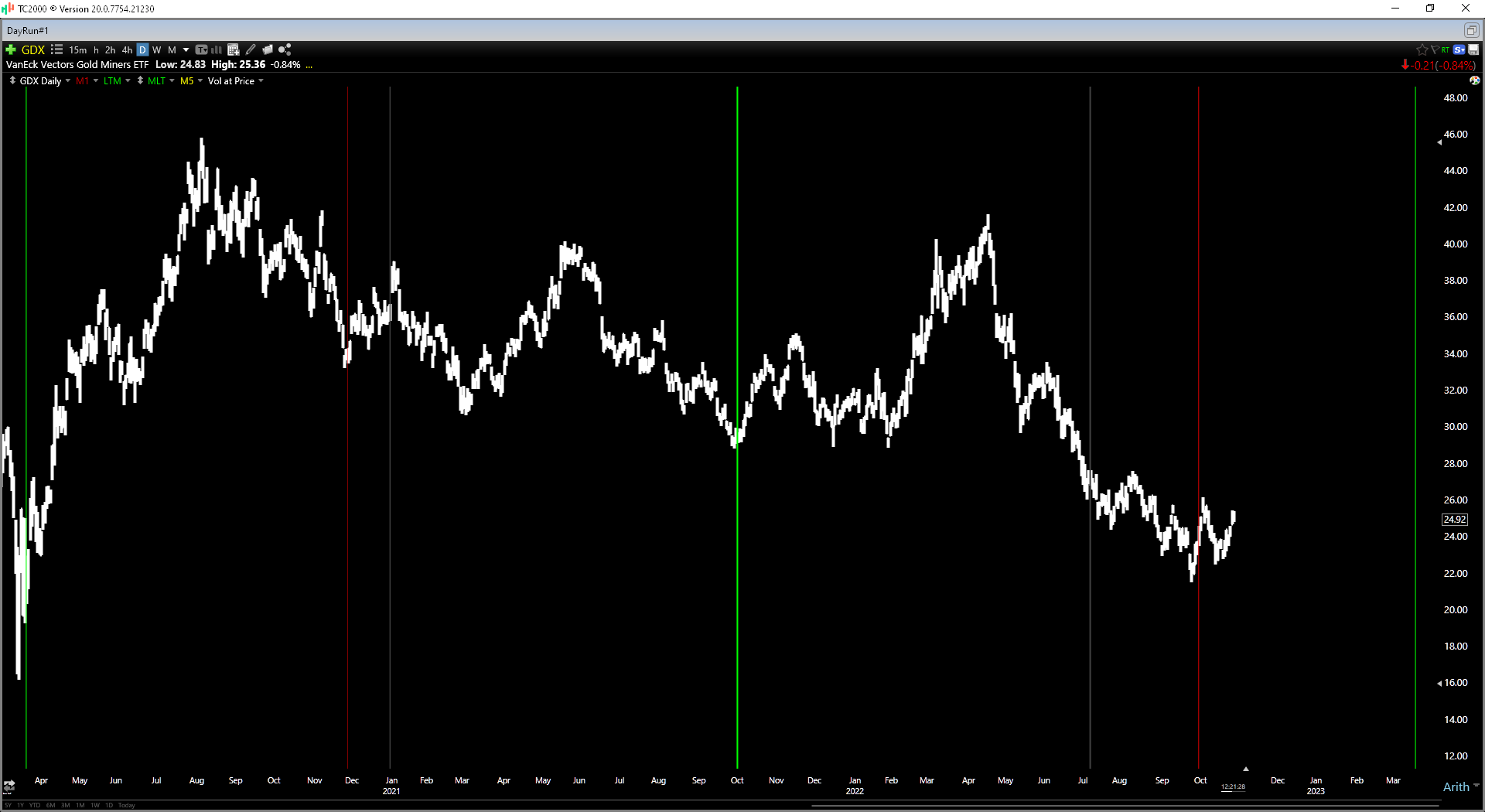

But, towards the end of November 2021, things began to change.

In November of 2021, the Nasdaq was up 130% on a five-year chart but is now up just 61%. The same chart shows the Dow was up 55% when the NASDAQ hit its peak but is now up just 37% over the last five years. On a year-to-date chart, the NASDAQ is down 31%, while the Dow is off just 11%.

If you look at individual technology stocks, it can get even worse. For example, Tesla is down 44% year-to-date, while Meta is off more than 70% since the start of the year.

But, something like boring old Coke-Cola, is flat on the year. And I should mention Coke is yielding a 2.96% dividend, which, if calculated into the year-to-date return, would put your investment ahead for 2022. Not very many big-name NASDAQ technology stocks can say that.

Every investor wants a big return. Seeing a stock climb 10, 20, 30 percent, or more in a single year. And it certainly beats seeing a stock climb a measly 4 to 6 percent.

However, the more important thing investors need to remember is that when stocks rise by double digits or more, they probably carry a lot more risk than a stock that hardly looks alive.

The Dow Jones Industrial average is full of stocks that creep along. They don't seem like suitable investments if you look at them on one-year charts. But, over decades, these stocks have been outstanding performers, especially if you add dividends, when considering their total returns.

Furthermore, the slow growth comes with low, or at the very least, much lower risk than the higher return stocks. That low risk could be what keeps you from making a rash decision with your portfolio.

When a holding in your account is down 40 or 50 percent in a year, it is easy to simply say you are cutting your losses and selling the stock.

However, history has proven the best method of investing is a long-term buy and hold. And that means holding stocks when they are down or lost massive amounts of value. Continue reading "The Downside of High-Reward, High-Risk Investing" →