It’s been a rough year for the restaurant industry, with the index declining over 40% from its highs, and many weaker operators like Red Robin (RRGB) cut in half.

The bear market in these names has been attributed to commodity and wage inflation which has pinched margins, but also due to very difficult year-over-year comps following the surge in traffic from government stimulus and diners anxious to get back to everyday life in Q1/Q2 2021.

Unfortunately, while restaurants should have been out of the woods by Q3 2022 after lapping these insurmountable comps, they’re now contending with a new issue: traffic. This has resulted from shrinking discretionary budgets with consumers hit with rising mortgage payments, rising gas prices, and the cost of groceries continuing to skyrocket.

So, while margins held up relatively due to sales leverage in 2021 and menu price increases, it could prove more challenging to pass on costs this year.

The good news is that while much of the sector has been sold off for a good reason, a few companies are being dragged down with little justification due to the bearish sentiment.

Two companies that meet these criteria are Wingstop (WING) and Restaurant Brands International (QSR), which have found themselves more than 35% from all-time highs. Let’s take a closer look below:

Wingstop (WING)

Wingstop is a mid-cap restaurant company offering classic wings, boneless wings and tenders, and it has enjoyed considerable growth since going public.

The company has seen its store count increase from 998 stores in 2016 to an estimated 1,950 in 2022, translating to an impressive 11.8% compound annual growth rate. This is helped by the company’s phenomenal unit economics (sub-two-year payback), making it an attractive brand for multi-unit franchisees.

So far, the company’s unit growth is not slowing despite its scale, with an estimated 250 stores to be opened in 2023, representing a 13% growth rate.

Although discretionary spending budgets are declining, Wingstop is in a unique position. This is because it has a relatively low average check compared to casual dining restaurants. Besides, while we are seeing commodity inflation in most proteins (beef, seafood, pork), bone-in wing prices are seeing deflation.

So, while other restaurants might be raising prices to protect margins, even if at a slower pace, to ensure they don’t hurt demand, Wingstop could hold prices steady, allowing its value proposition to stand out among its competitors in the quick-service space.

Therefore, Wingstop looks to be an interesting defensive play in the restaurant space, and I would not be surprised to see the stock trade back above $110.00 before year-end.

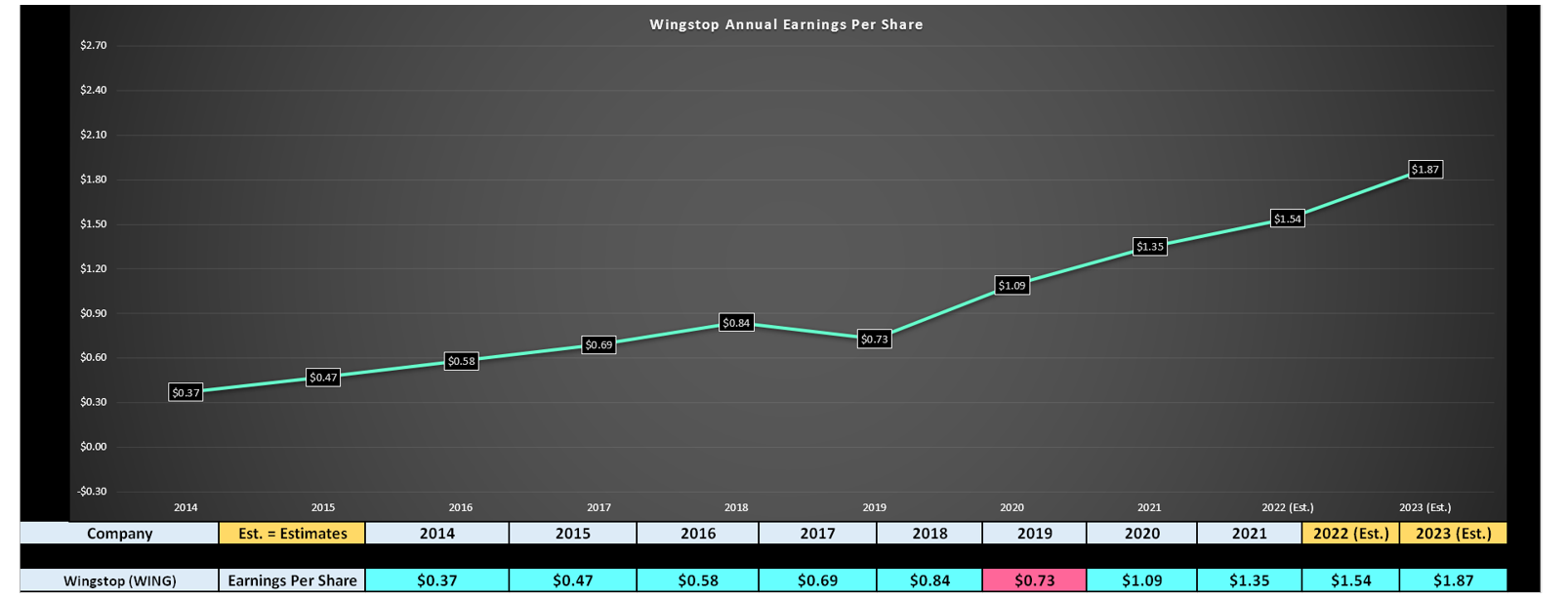

Looking at the chart above, Wingstop is not cheap, which is why I’m not long the stock yet, given that it trades at more than 48x FY2023 earnings estimates ($1.87). However, the stock does deserve a premium multiple given its double-digit unit growth rates and ability to grow earnings at a rate well above that of its peer group.

Based on what I believe to be a conservative EBITDA multiple of 24 and FY2023 EBITDA estimates of $130 million ($4.33), I see a fair value for the stock of $103.90, pointing to an 11% upside from current levels.

However, given that I prefer to buy at a minimum 20% discount to fair value, I think the name is one to keep a close eye on, but the ideal buy zone is at $83.00 or lower on any dips.

Restaurant Brands International (QSR)

Restaurant Brands International is a large-cap restaurant company with a leading franchised position among its peers, with over 99% of its restaurants franchised.

The company is best known for its brands Popeye’s Chicken, Burger King, and Tim Hortons, but it also recently acquired Firehouse Subs, a rapidly growing, digital-focused sandwich company with over 1,200 restaurants.

This acquisition pushed the company’s total restaurant count to more than 29,000, but it is confident that it can push its total store count above 40,000 by 2027. This would translate to more than 35% growth from current levels, making it more attractive than McDonald’s (MCD), in my view, which is relatively saturated and must rely on same-store sales than global expansion.

The key differentiator for Restaurant Brands is that it could be a trade-down beneficiary. While consumers might cut back in a recession, they are less likely to cut back on things that offer value and convenience. When it comes to a morning coffee/sandwich on the way to work or lunch coffee/snacks like Tim Hortons offers or value meals from Burger King and Popeye’s, I see these as staples more than discretionary items.

In contrast, one might argue that fine dining and casual dining are highly discretionary. Therefore, I do not expect the negative traffic trends that we’re seeing in casual dining to seep into the quick-service space, and if they do, I expect them to be much less pronounced.

I also believe that QSR has a much better chance of mining customers’ data to drive additional visits, given its high proportion of digital sales. Finally, given the lower average check, I see less resistance to menu price increases in quick service vs. casual dining.

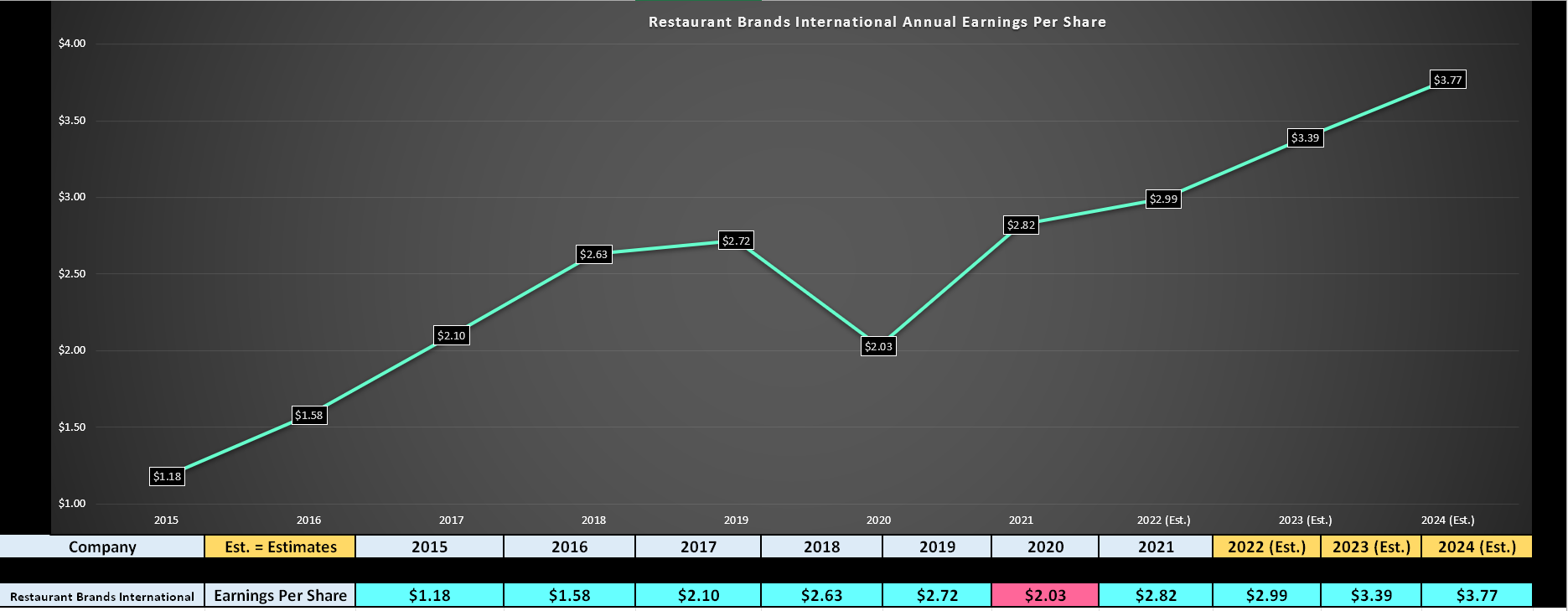

Looking at the chart below, we can see that QSR is currently trading at barely 15x FY2023 earnings estimates at a share price of $51.00, which pales in comparison to MCD at ~23x earnings and YUM at ~21x earnings.

In my view, this is completely unjustified, even if QSR’s largest brand (Burger King) is seeing a slower turnaround than planned. Even if we apply a discount and use a more conservative earnings multiple of 19.5x FY2023 earnings, I see a fair value for QSR of $66.10 per share, translating to a 30% upside from current levels.

Combined with a 2.0%+ buyback and a 4.0% dividend yield, the stock is a steal at current levels.

It’s easy to be bearish on the restaurant space given all the headwinds, and there are certainly many names in the casual dining space that it’s best to avoid.

However, I believe names like QSR and WING have been unfairly punished and are now trading at their most attractive valuations in years following this pullback. Therefore, I see QSR as a Buy on any dips below $50.00, and I would view any pullbacks below $83.00 on WING as buying opportunities.

Disclosure: I am long QSR

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.