We've asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Silver Futures

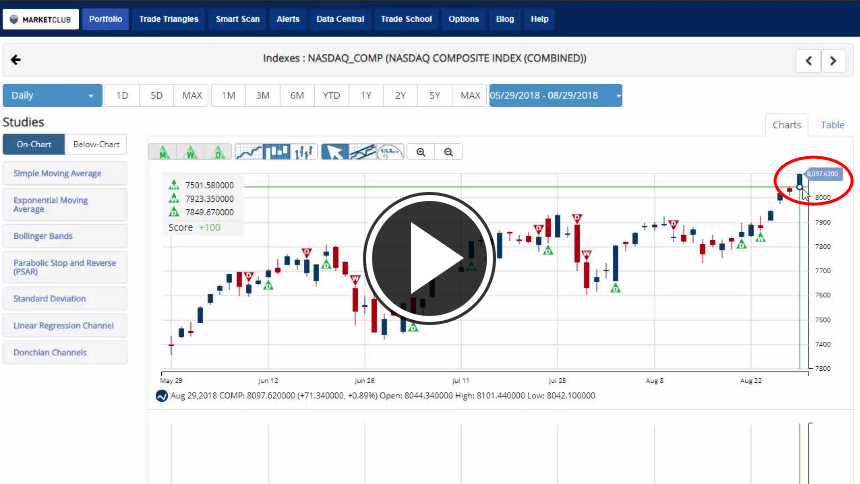

Silver futures in the December contract have traded lower for the 4th consecutive trading session at 14.55 an ounce continuing its bearish momentum as the U.S dollar is up 45 points trading off of a four week low. If you are short a futures contract place the stop loss above the 10-day high which was hit in Tuesday's trade at the 15.07 level as an exit strategy as it looks to me that we will retest the August 16th low of 14.40 soon as prices are still trading under their 20 and 100-day moving average as clearly the trend remains negative. Silver prices are stuck in a three-week trading range consolidating the recent sell-off in price. I still see no reason to own any of the precious metals as the U.S. stock market is hitting another all-time high this week. I'm also recommending a bullish S&P 500 trade which continues to roll along on a daily basis as money flows continue into U.S equities and out of the precious metals so stay short & place the proper stop loss. If you take a look at the daily chart, the downtrend line remains intact. However, if the 15.07 level is broken that will also be breached as then it would be time to sit on the sidelines while waiting for another trend to develop.

TREND: LOWER

CHART STRUCTURE: EXCELLENT

VOLATILITY: AVERAGE

Continue reading "Weekly Futures Recap With Mike Seery"