Reddish Metal Disagrees With GDP Readings

Chart: Aibek Burabayev; Data: World Bank, CME group

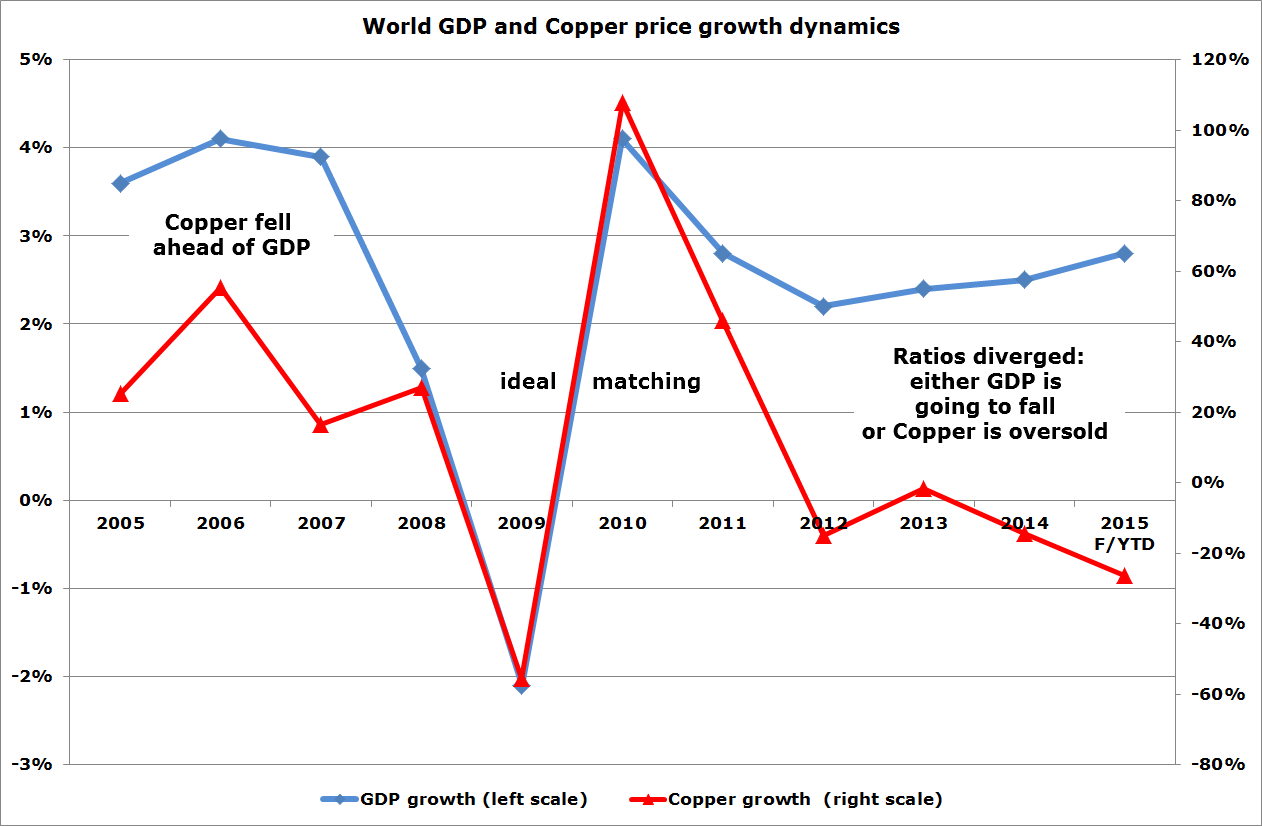

Copper is a core element of our everyday life and it will only grow to be even more important in our digital life as we strive for comfort. The diagram above shows it without saying a word.

The 10-year dynamics of the GDP and Copper growth had the same trajectory, at least until 2014 when the ratios diverged. In 2005-2007 the metal had fallen ahead of the GDP with a steeper curve in 2007 and then both indicators met in the collapse of 2008-2009. And then, amazingly, the ratios proceeded to keep together on the graph showing ideal matching from the bottom to the top in 2010. Continue reading "Copper Points At Weaker Economy?"