Hello traders and MarketClub members everywhere. Today, I am going to be looking at what could be an amazing coincidence in Apple. It could also be a profitable opportunity for alert traders. Before we get into that, I hope you all had a chance to look at yesterday's special post on gold. If you didn't, please check it out right here.

It is the last day of the trading week, with both the stock and bond markets closed tomorrow for Good Friday.

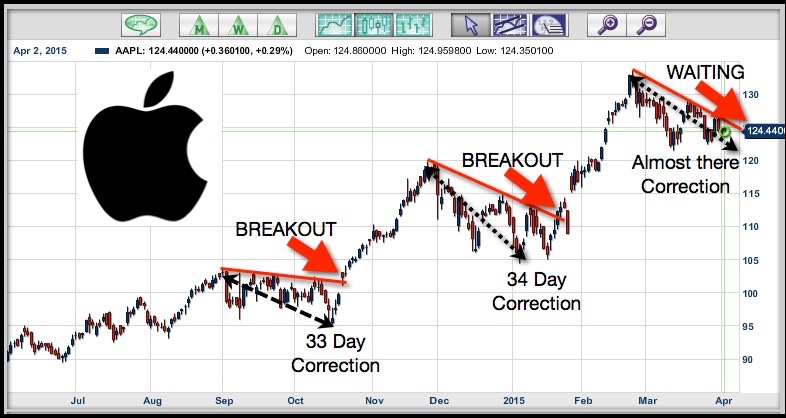

I want to lay out for you a potential trading scenario for Apple stock. To that end, I have shown on the below daily chart what I think is going to happen in the future.

In approximately 7 days from now, give or take a couple of days, Apple should offer an amazing buy opportunity if this scenario plays out like I think it will.

It appears after making a high, Apple sort of drifts back for the next 33 to 34 days before it once again has a sharp upward move. If that same scenario plays out this time, then somewhere between the 10th and 12th of April would be in ideal time to look at getting long stock in Apple. On April 10th, Apple is going to begin taking preorders for its new Apple Watch, coincidence maybe. I'm sure there will be legions of loyal Apple fans waiting and wanting the latest gadget from Apple. Continue reading "Is This Apple's Secret Or One Amazing Coincidence?"