Hello traders and MarketClub members everywhere! Well I have to admit it, I did take a few days off to fly down to Cancun last week to get some sunshine and warm weather. If you're based anywhere on the East Coast, you know it has been very, very cold, the coldest weather we have had in 170 years! So I thought it was time to sneak off and get some warm weather for a few days.

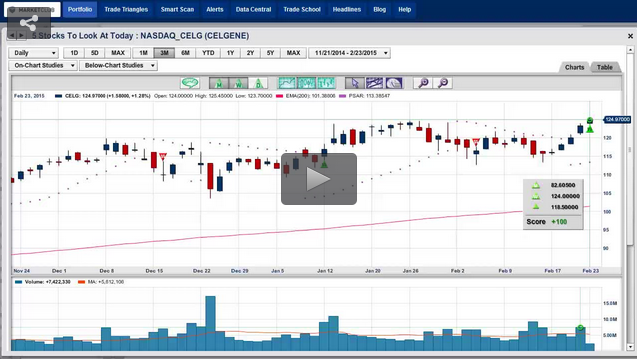

When I come back from a trip, I immediately look at the Trade Triangles to see what is happening in the marketplace and what stocks are on the move. Today was no different, I simply clicked on the Trade Triangle button and I searched for stocks that were in uptrends, but had a continuation signal today. In simpler terms, I was looking for stocks that were in uptrends that had given a weekly Trade Triangle signal today indicating that the upward trend was once again resuming.

I filter the list down to stocks that have good volume and have traded on average over 2 million shares a day. When you look for stocks that have that type of trading volume, you know that the big boys, the hedge funds and institutional investors, are also looking at those same stocks as well, so you're in good company. Continue reading "5 Stocks On The Move Today"