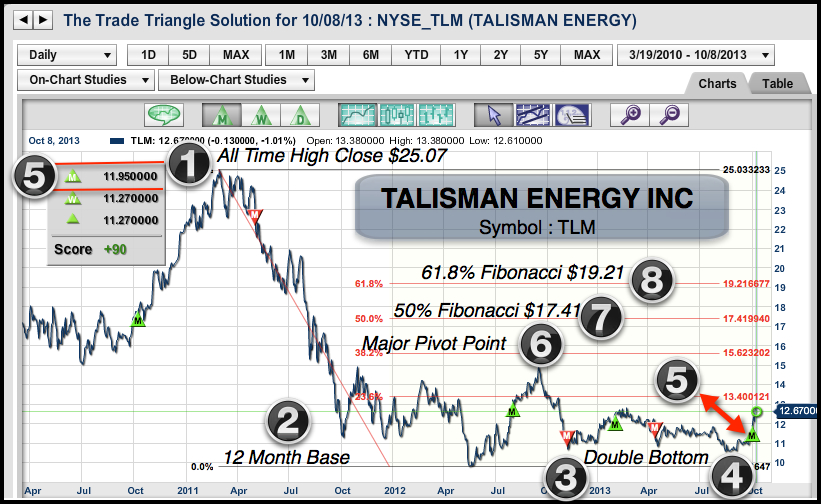

This morning as I was looking over the news, I read with interest that Carl Icahn had taken a 6% stake in Talisman Energy Inc (NYSE:TLM). Talisman Energy is a large Canadian energy company.

On October 1st, the Trade Triangles flashed a major buy signal for Talisman Energy at $11.95. I suspect that this was partly due to the price action that was reflected by Mr. Ichan's purchase of Talisman shares.

1.All Time High. (2) 12 Month Base. (3) +(4) Double Bottom. (5) Trade Triangle Buy at $11.95.

(6) Major Pivot Point. (7) 50% Fib Retracement $17.41. (8) 61.8% Fib Retracement $19.21.

What is also interesting is how Mr. Icahn picks stocks like Talisman Energy. I have witnessed the same actions in play in several other stocks that Mr. Icahn has purchased in the past 12 months. Stocks like Apple, Netflix, Herbalife, and most recently, Talisman, all display similar characteristics. I suspect that the technicals play a part in his overall approach to the market. The timing of Mr. Icahn's stock purchases are amazingly close to the timing of our Trade Triangle buy signals.

Today, we are looking at a chart of Talisman Energy and the stock action looks good from a technical viewpoint, as well as from our Trade Triangles. The potential for this market to go significantly higher is there, in my opinion. Of course, I will be using our Trade Triangles for money management to exit this position, should it not work out the way I expect it to.

As always, please share your thoughts with us on this or any other market.

Adam Hewison

President, INO.com

Co-Creator, MarketClub

As we start the new trading week, there are a lot of challenges we are facing with the partial government shutdown still in effect, the looming debt ceiling, and the numerous other problems plaguing the US at the moment.

As we start the new trading week, there are a lot of challenges we are facing with the partial government shutdown still in effect, the looming debt ceiling, and the numerous other problems plaguing the US at the moment.