In all the years I've been tracking the Fed and the previous chairmanships, Janet Yellen is coming across as being totally out of her league and just plain incompetent. Now before anyone says that's a sexist remark, I would say the same thing about her predecessor "Helicopter Ben." Whose big idea was to do everything the opposite way of what they did in the "Great Depression" and that is, to print money, print money and print even more money. The bottom line is the Fed has no idea how to get out of this quandary that they created themselves and for the country.

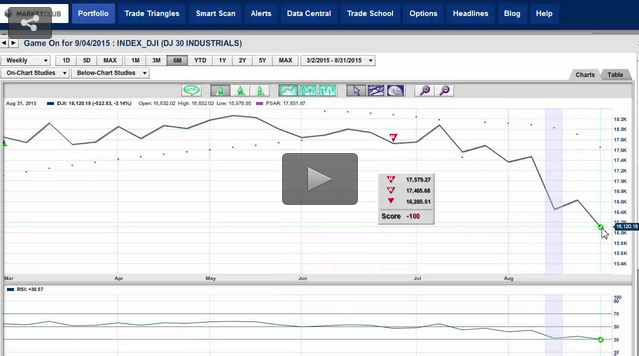

What's going to happen no one knows for sure, but one thing is certain, the markets will tell us where they want to go eventually. The other thing that's certain is that the Trade Triangles will get it right. I'm 100% confident in saying that.

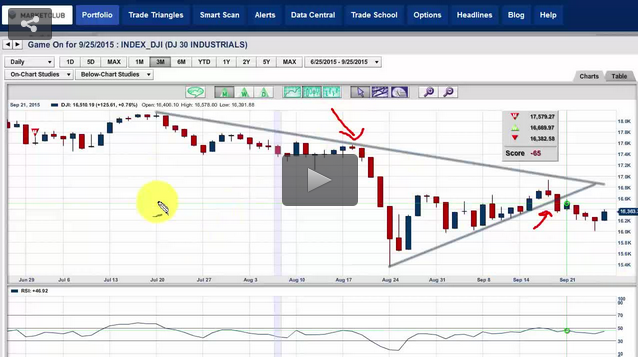

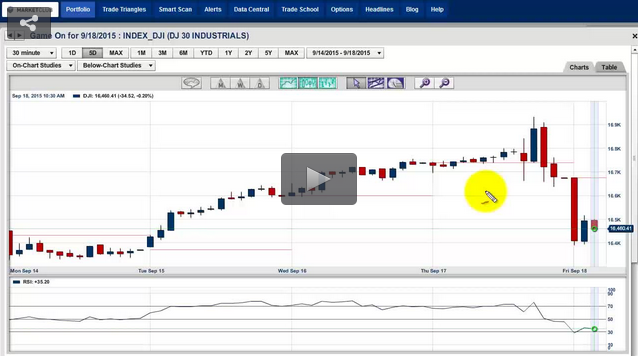

Let's just take it and look at where the markets closed last Friday. Continue reading "Is It Just Me Or Is Janet Yellen Incompetent"