It has been a great week with some strong trades happening. One of those stocks has to be LinkedIn Corporation (NYSE:LNKD), the professional social media site that recently updated its website with a redesign. After the bell yesterday, LinkedIn announced its earnings and future outlook. Upon seeing the numbers, investors bolted to the escape doors as LinkedIn clearly missed its target and future outlook.

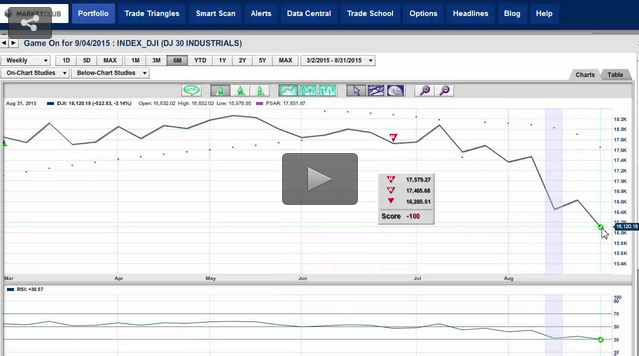

Did this come as a big surprise to us at MarketClub? The answer, in all honesty, is no as all of the Trade Triangles were negative indicating a lower trend for LinkedIn.

It is hard to ignore the power of the Trade Triangles during earnings season. Continue reading "Did you see LinkedIn (LNKD) Today?"