It is time for my traditional yearly post to find out which fiat could beat the conventional store of value this year.

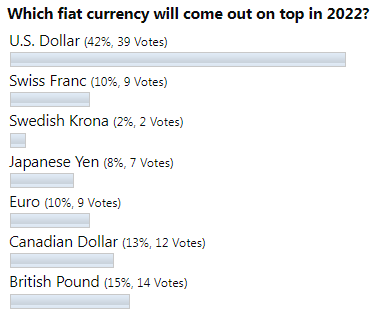

Let us see below how you predicted the future back at the end of December 2021.

The U.S. dollar was again the favorite bet for many of you. The next choice was the British pound, likely because it finished second in 2021. Among the top three bets, the Canadian dollar was an interesting choice that could be justified by the previous top ranking.

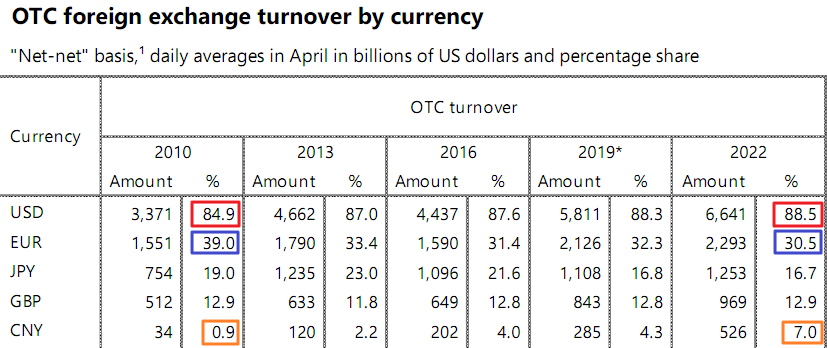

This time I changed the list of currencies to include only the top 5 currencies based on real foreign exchange turnover according to the Bank for International Settlements as per the table below.

The following top 5 fiat currencies are listed in the table above: U.S. dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP) and Chinese yuan (CNY). Continue reading "Top Fiat vs Gold in 2022: Focus on Inflation"