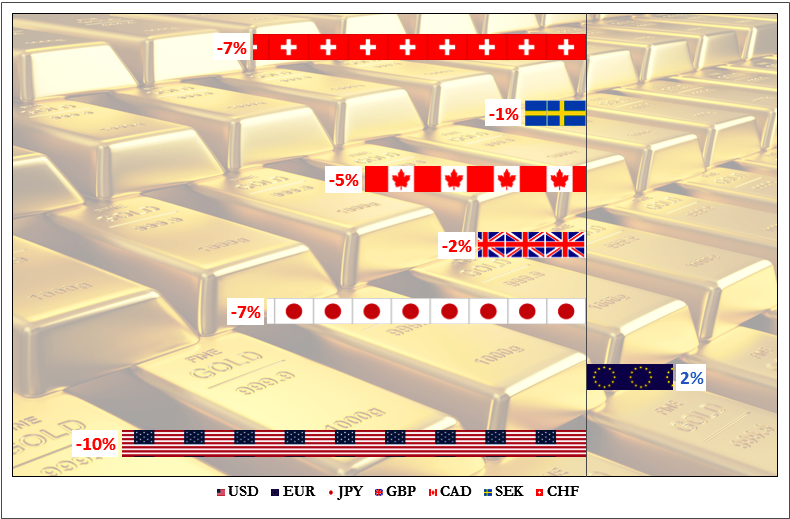

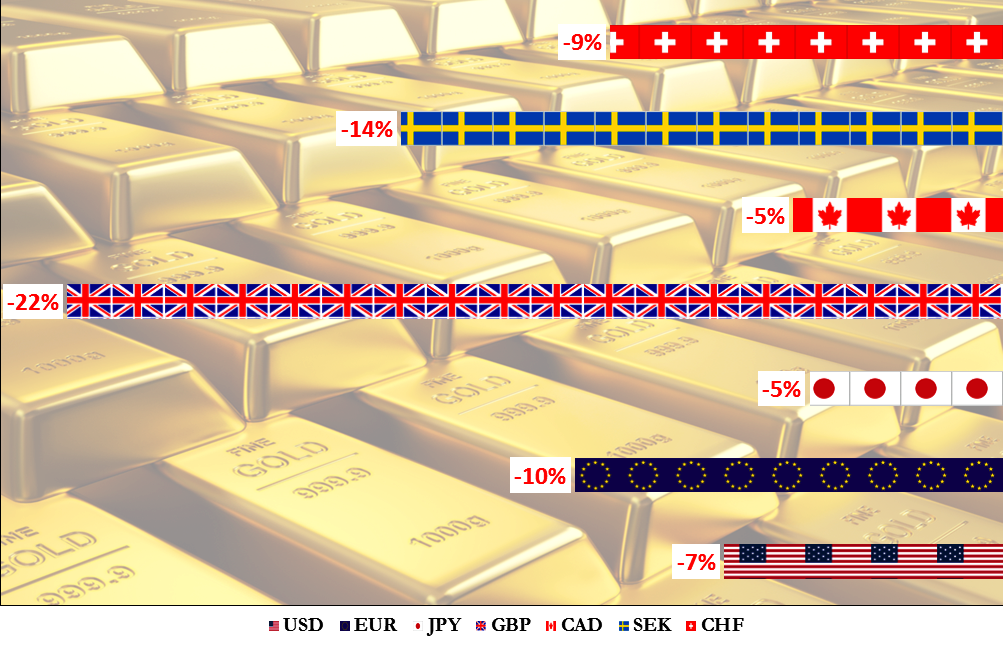

It’s time to find out in this traditional yearly post if there were any currencies that could beat the mighty gold this year.

7 currencies represent the fiat money: US dollar (USD) and 6 components of the US dollar index (DXY) placed by weight: euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK) and the Swiss franc (CHF). This time I added the Bitcoin from the crypto-world.

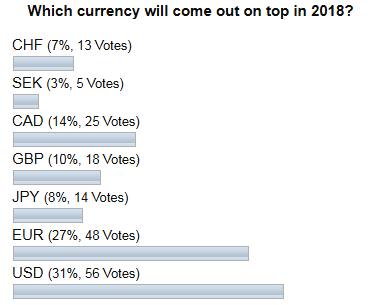

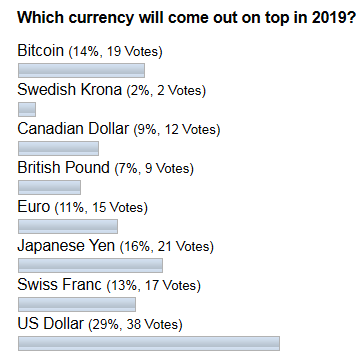

Before we get down to the results of 2019, let us see below how you forecasted the future back at the end of December 2018.

The majority of you again, as last year, bet that the primary currency (USD) would defeat all other rivals to come out on top in 2019. The readers’ geography played a crucial role here. The second choice was the Japanese yen; I guess it was selected as it topped the chart last year.

Bitcoin ranked the third; it was the top loser last year. It looks like some readers watch my Pendulum experiments closely.

Let’s look at the diagram below to find out the results. Continue reading "Top Currencies VS. Gold In 2019: Last Man Standing"