Before we start to analyze the mighty metal, I would like to mention that the crude oil futures Buy Setup was triggered last Friday as the futures price broke above $52.25. Please mind the risk if you trade and I wish you good luck there.

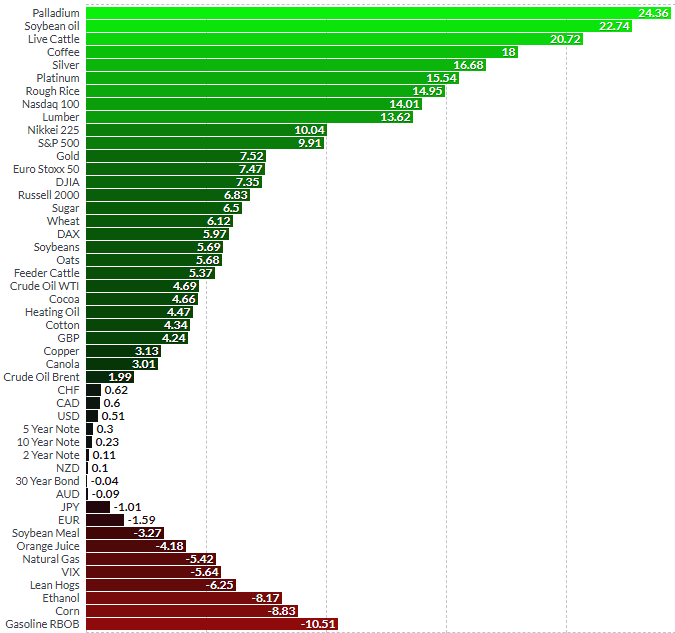

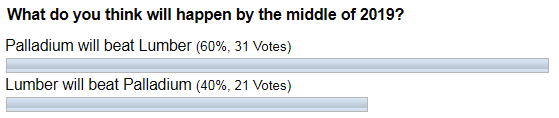

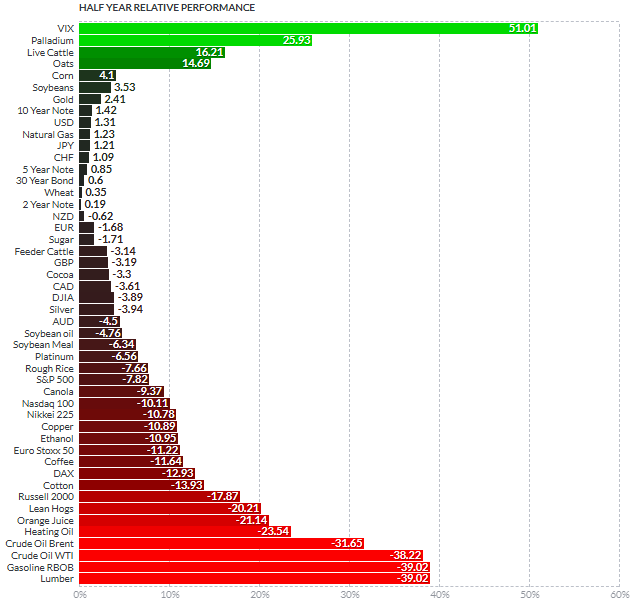

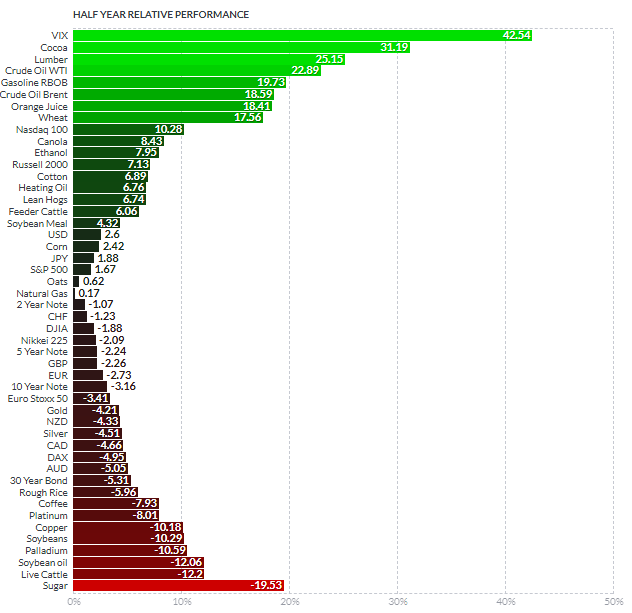

Now let’s get down to the metal. Earlier this year, we pushed a new Pendulum with regular champ palladium on board. Before you bet for Pendulum winner, I tailor charts for pitted instruments and so I did for palladium using the daily time frame. The outlook was quite ambitious as the bullish target was set at $2140 while the price was hovering around the $1900 level. The majority of you chose the former winner palladium as a new winner again against the logic of the experiment and I don’t blame this choice as this precious metal hits all charts amid strong demand. That target was reached within a week after the post had been published.

I detected a promising pattern on the daily palladium chart and I would like to share it with you as it still emerges.

Chart courtesy of tradingview.com

Palladium futures hit the all-time high at $2427 on the 23rd of January. It’s quite natural that the correction followed as traders have booked profits after the price reached another record. Continue reading "Is Another All-Time High Ahead For Palladium?"