It's hard to believe that we just have one more trading day in January, which has been an extraordinarily volatile month and one that will certainly go down in the history books.

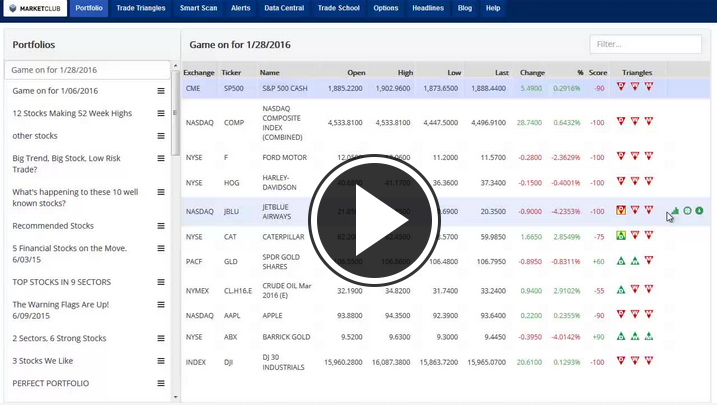

Many of the well-known large stocks are now in downtrends and are not likely to have major turnarounds anytime soon. One has to remember that the stock market looks six months ahead. While many of the companies are perhaps enjoying some good earnings, this may be the last good earnings season we see for some time to come.

On a brighter note, my trade in Apple Inc. (NASDAQ:AAPL) turned out well and it would now look as though Apple is going to be on the defensive for several months. I can see this stock continuing to erode down to perhaps the $80 level.

Let's look at some other well-known stocks that are all in major downtrends at the moment. Continue reading "One Day Does Not Make A Trend"

As much as we talk oil here, I wanted to bring in an outside source to give you some insight into what he thinks is the replacement (potentially) of oil, and what might be a great play for you very soon. That expert is Horacio Marquez, Editor of the

As much as we talk oil here, I wanted to bring in an outside source to give you some insight into what he thinks is the replacement (potentially) of oil, and what might be a great play for you very soon. That expert is Horacio Marquez, Editor of the