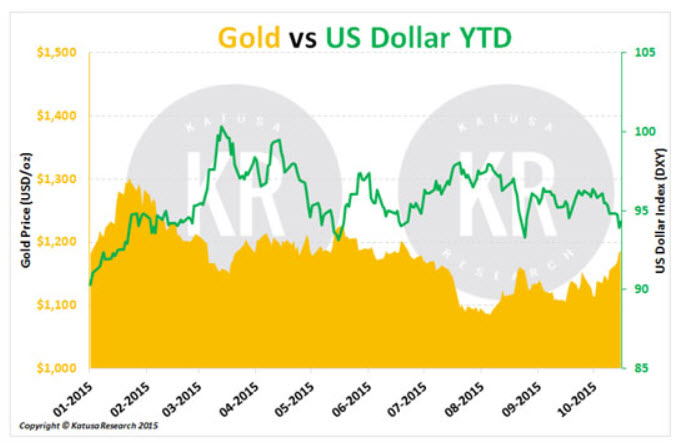

The Gold Report: Byron, gold is above $1,300/ounce ($1,300/oz)although not by much and silver topped $20/oz. What was holding their prices down, and what are the fundamentals that will move the prices going forward?

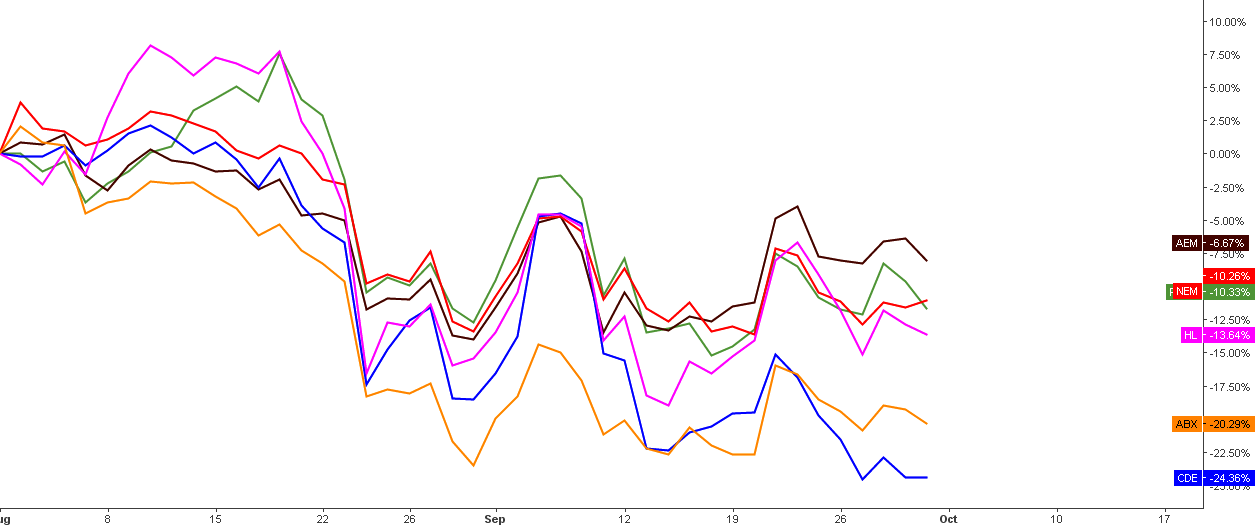

Byron King: The short answer is that, for all its faults, the dollar has strengthened, which holds down gold and silver prices. The longer answer is that gold and silver are manipulated metals. That is, the world's central banks have an aversion to things they can't control, and one of the things that they can't control is elemental metals like gold and silver.

Let's ask why the dollar has strengthened. The U.S. is probably in its weakest geopolitical situation in decades. The Wall Street Journal on July 17 had a front-page story about the confluence of crises across the world Ukraine, Middle East, Southeast Asiaall of which are profound challenges to American power militarily, diplomatically and economically. But the dollar is still holding up. Why?

I believe the dramatic recent increase in U.S. energy production is what's behind the stronger dollar. With more oil and natural gas from fracking, the U.S. is the world's largest energy producer. In addition, we're importing far less oil and exporting a lot more refined product. It helps the dollar.

Still, when I look at the big picture for gold, I see a resource whose production is challenged on the best of days. Output is declining in the major traditional sources: South Africa is in decline; Australia is challenged; some of the big plays in Nevada are getting long in the tooth. Continue reading "Miners Must Control Costs to Improve Share Prices: Byron King" →