It has been a classic washout in the gold stock sector, but if positioned correctly opportunity is setting up.

- The ‘macro’ and sector fundamentals have been incomplete.

- The technicals have advised a downtrend since mid-2020 with the exception of one head fake in March-April, 2022.

- Sentiment, which was over-bullish in mid-2020 and April 2022 is now opposite, and very bullish on a contrarian basis.

- The sector is deeply oversold as evidenced by an extreme in the Gold Miners Bullish Percent Index (BPGDM).

- Commitments of Traders data for gold and silver are positive and very positive, respectively on a contrarian basis.

- As has been proven by the facts of recent history, the view of cyclical (as opposed to ‘stag’) inflation being terrible for gold stocks was correct, even as this view was lost in the din of opposing – and tragically wrong – opinions by heavily followed Twitter ‘influencers’ and other dignitaries.

So here we are, intact.

What have you done for me lately, smart guy? Err, not much. There has been a lot of waiting, biding time, trading other areas and sitting on cash; a high percentage of it.

But as speculators, traders and/or investors are we not called upon to never set our views in stone? Are we not called upon to be ready to capitalize on extreme events within the markets? When the herds run one way we need to be ready to go the other. The herds are not prepared because they’re either already deployed or too busy running from losing positions.

Gold bug herds, AKA less experienced or analytically critical precious metals bulls, are currently running that way, over that cliff over there. They have been herding since August 2020, when we first noted the danger.

Such events climaxed in 2008 and 2020 too. In each of those instances a crash took place and it coincided with fundamentals slamming into place. Crashing gold stocks + ramping fundamentals = big time buy opportunity.

As noted in the first bullet point above, the fundamentals have not slammed into place on this cycle. They are grinding into place, slowly and outside the limits of the average market participant’s patience. But that is exactly why contrarian investing is so difficult. It is very hard to have patience when time takes what it takes for an opportunity to play out, especially when your viewpoint is not reinforced by a majority.

So that is the background. We have been more than prepared in managing risk. That is how markets often go… manage risk > manage risk some more > manage risk for so long you almost lose sight – in real time – of why you’re there and what your job is > and then PREPARE TO CAPITALIZE.

Intact players should now be considering the big sentiment event on tap for next week as the Fed, which was jerked kicking and screaming into hawk mode by the bond market, prepares to render its big decision (on July 27 they will either hike the Fed Funds by .75% per 71% of CME traders or 1% per 29% of CME traders).

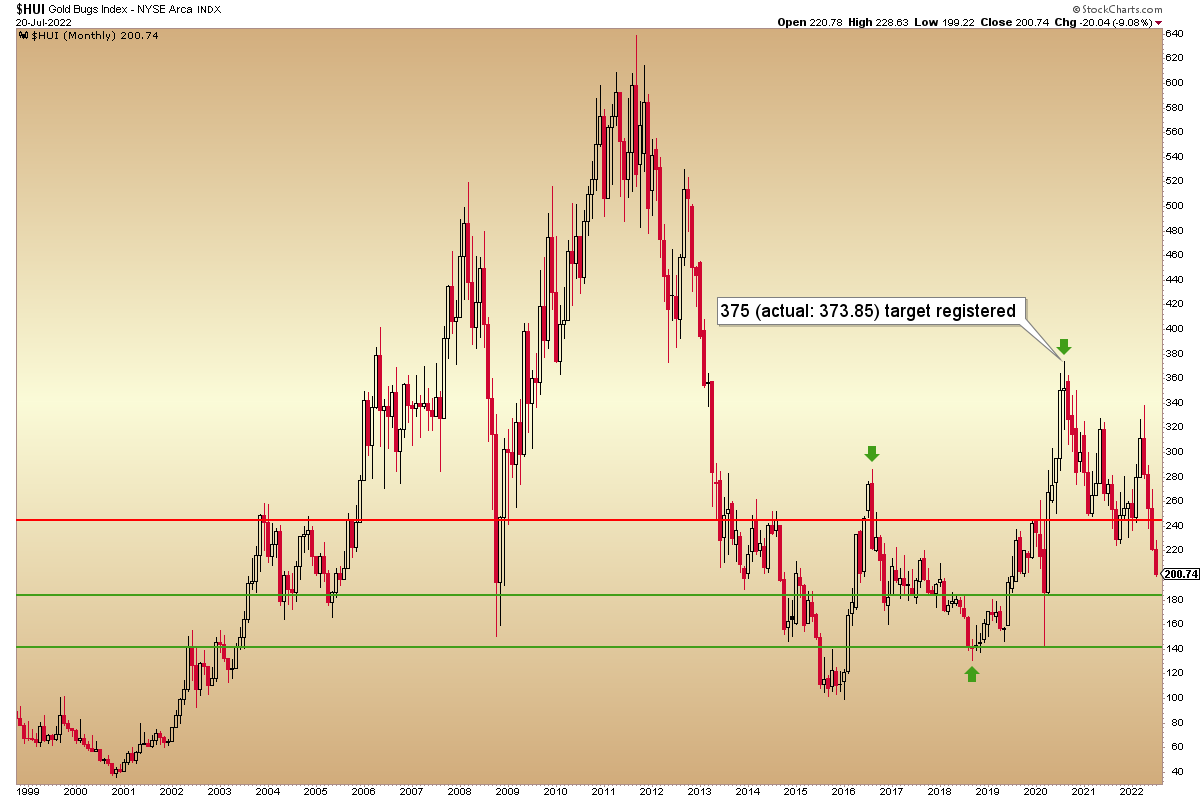

Meanwhile, the Gold Bugs index is tanking toward a higher low to the 2018 low, which is really all it needs to do to keep the volatile series of higher highs and higher lows (AKA a bull market) intact.

I use shorter-term charts and of course the ‘macro’ and sector fundamentals and sentiment to fine tune the situation, but this general monthly chart picture should not only cause no concern for would-be buyers who are well prepared; it should stimulate greed while a majority of bugs are gripped in fear.

For “best of breed” top-down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates, and NFTRH+ dynamic updates and chart/trade setup ideas. Follow via Twitter @NFTRHgt.