Last year was another good year for the stock market with all the indices ending up on a positive note.

The DOW was able to make it into the positive column by 7.5%, the S&P 500 managed to outdo the DOW with a double digit return of 11.5% and standing on the top of the hill was the NASDAQ index, which put in a stellar 13.9% performance for the year.

What if there was another way to make money, one that had about the same amount of risk, but produced higher returns on your money - now that would that be interesting, don't you think?

Two years ago, we started our model Internet portfolio which consists of 5 stocks. We divided the funding for this portfolio into 5 equal amounts of $10,000 each and used that to trade as many shares as we could both from the long and short side of the market.

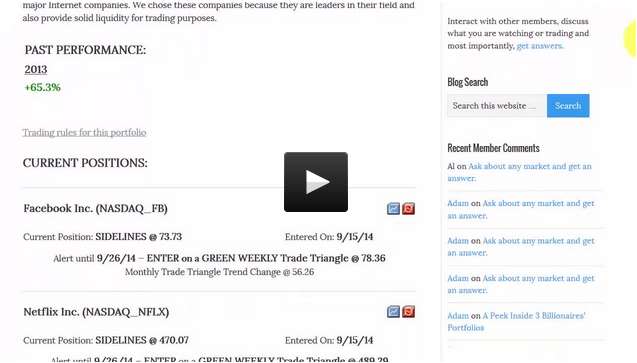

The stock we chose to trade in this Internet portfolio are Facebook Inc.(NASDAQ:FB), Netflix Inc. (NASDAQ:NFLX), Yahoo! Inc. (NASDAQ:YHOO), Yelp Inc. (NYSE:YELP), and finally Amazon.com Inc. (NASDAQ:AMZN). Based on the stock's price, we traded the maximum number of shares we could for each stock, rounding down if needed.

The first year tracking this portfolio (2013), we had a stand out year with a return of 65.3%. Last year (2014) this portfolio performed well, easily outperforming all the major indices and beating the top performing NASDAQ. For 2014, the Internet portfolio put in a super performance of 16.4%. While not as good as 2013, it was nevertheless a very positive one when you measure it against other stock portfolios.

The signals for this portfolio, along with our other two model portfolios, the World Cup portfolio and the Perfect ETF portfolio are provided for you.

If you are looking to start 2015 off on the right foot, with a clear direction, then one of these model portfolios could be the answer you are looking for. Each portfolio carries, like all investments, a degree of risk.

The most conservative portfolio is our Perfect ETF portfolio. The Internet portfolio has a slightly higher degree of risk. Our World Cup portfolio carries the most amount of risk and is not for everyone. However, it does have a place in large portfolios as a non-correlating asset class.

Have a question about the Internet portfolio? Please comment below this post.

Every success in 2015 with any of MarketClub model portfolios!

Adam Hewison

President, INO.com

Co-Creator, MarketClub