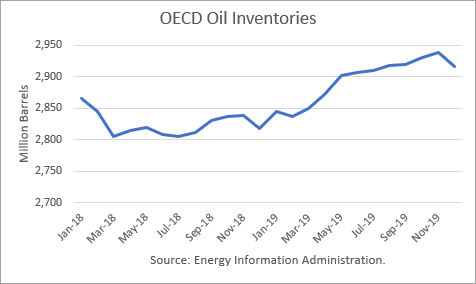

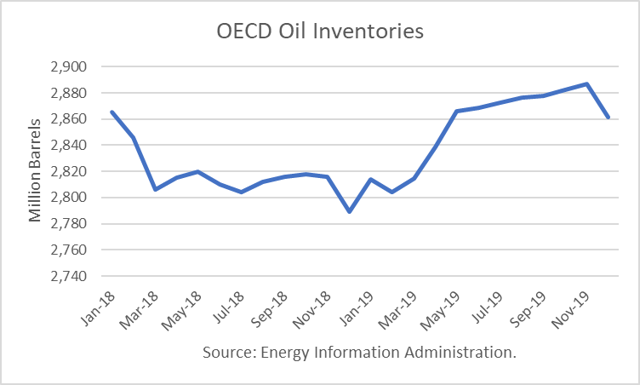

The Energy Information Administration released its Short-Term Energy Outlook for November, and it shows that OECD oil inventories likely bottomed in June at 2.807 billion barrels. It estimated a large 20 million barrel gain for October. Though it forecasts that stocks will drop in December to 2.867 billion, that is 50 million barrels higher than in the October outlook.

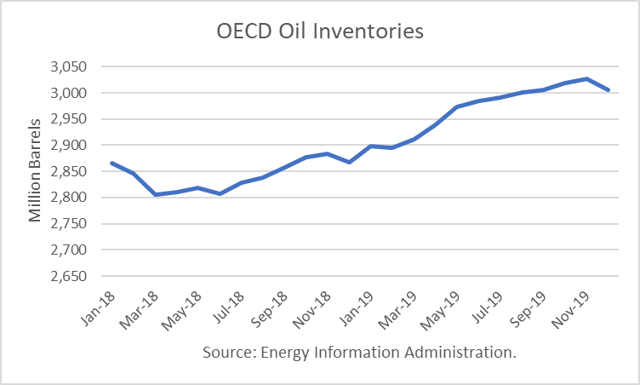

Throughout 2019, OECD inventories are generally expected to rise, reaching 3.0 billion barrels in August. It projects ending the year with 138 million barrels more than at the end of 2018 in glut territory.

The moment of truth has come, and it appears that the sanctions will cut less of Iran’s production and exports than has been added by OPEC+ producers and the U.S. That is why oil prices have been dropping for eight straight sessions.

Oil Price Implications

I performed a simple linear regression between OECD oil inventories and WTI crude oil prices for the period 2008 through 2017. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent. Continue reading "World Oil Supply, Demand And Price Outlook, November 2018"