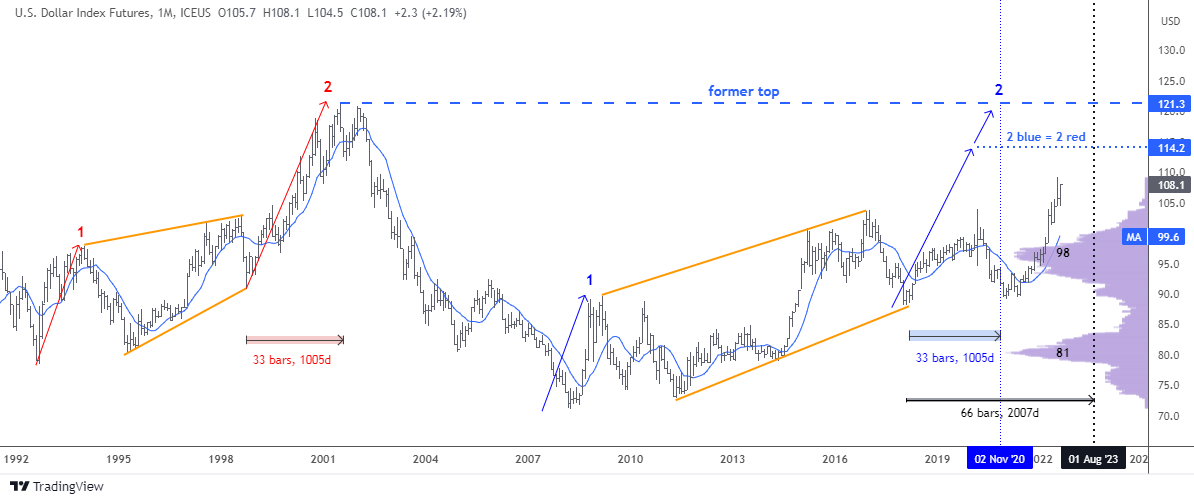

More than three years ago in my post titled, “Don't Get Trapped By Recent Dollar Weakness”, I shared with you a monthly chart of the dollar index (DX) futures with a map of large two-leg complex sideways consolidation. It was an experiment to try guessing the time target for the second blue leg to the upside based on the time it took second red leg to emerge.

Below is the updated chart with the same drawings enriched with the new highlights.

The time target was set on November 2020 when 33 bars in the second blue leg up emerge. The price had established the new top of $104 in March 2020 within those 33 bars. However, the minimum target of $114.2 on the price scale had not been reached and now 54 monthly bars appear on the chart.

If we divide 54 by 33 we will have the ratio of 1.64, which means the time period extended over the 1.618 Fibonacci ratio. This is a crucial time mark and last month the dollar index futures were really close to hitting the price target as it topped $109.1.

The next extension of doubling the time period with 66 bars to emerge falls on August 2023. It is enough time space for reaching both preset targets of $114.2 and $121.3.

I added two indicators on this updated chart. The purple one is the Volume Profile. It clearly has shown the strong barrier at the $98 level with the large volume traded there. When the price broke above that resistance, the speed of growth accelerated. It is the resistance being the strong support now. We should watch it closely in case the price drops there during correction.

The Simple Moving Average for the past year period is the blue line on the chart. It had accurately shown the reversal to the upside last year. The moving average confirms the support area of the Volume Profile indicator around $99.6 making it a double barrier for bears.

Three years ago the majority of readers misread the direction of the price as they bet on the drop of the dollar. Continue reading "Dollar Ran Out of Time, Not Ammo"