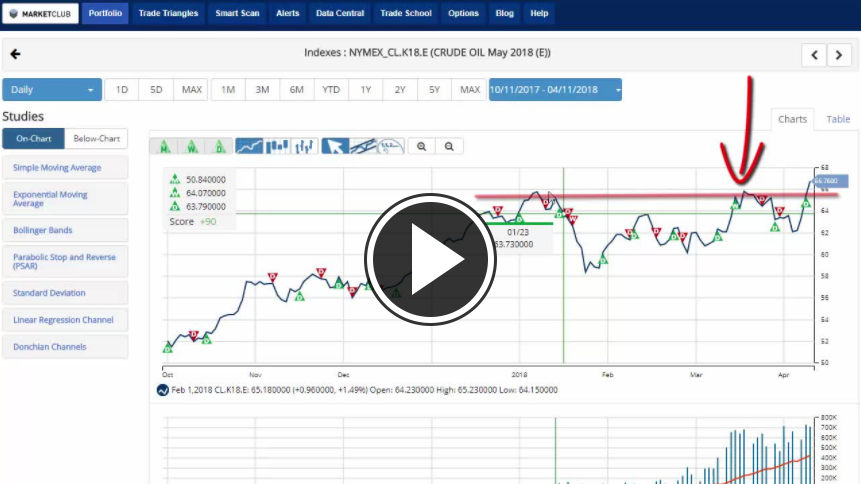

Hello traders everywhere. Global tensions have Rocked the oil markets today sending crude oil to a three year on the back of a +3% gain in Tuesday's trade. WTI crude is trading above the $66, a +2% gain, breaking through the previous levels of resistance were sitting just shy of $65. The last time the price oil was this high was in 2014.

The reason for the sharp upward move stems from comments by Russia and the United States over the conflict in Syria. Russia's ambassador to Lebanon told local media that Russia would shoot down American missiles headed Syria's way. This follows an alleged chemical weapons attack by President Bashar Assad that killed dozens in a rebel-held area over the weekend.

President Trump responded via Twitter saying:

"Russia vows to shoot down any and all missiles fired at Syria. Get ready Russia, because they will be coming, nice and new and 'smart!' You shouldn't be partners with a Gas Killing Animal who kills his people and enjoys it!"

To add to that, the Energy Information Administration (EIA) data on Wednesday showed swelling surpluses at the biggest domestic storage complex as well as nationwide last week. American crude production also climbed, while exports of American oil declined to 1.21 million barrels a day.

Key Levels To Watch This Week:

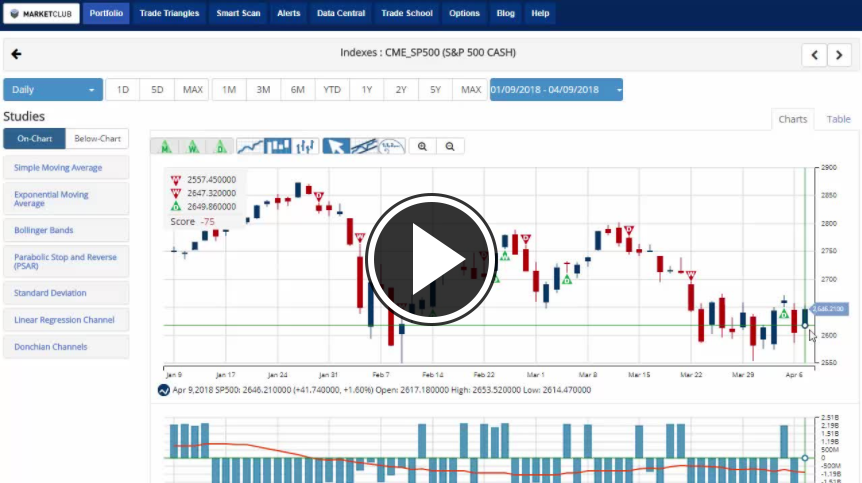

S&P 500 (CME:SP500): 2,741.38

Dow (INDEX:DJI): 24,977.65

NASDAQ (NASDAQ:COMP): 6,630.67

Gold (NYMEX:GC.M18.E): 1,330.10

Crude Oil (NYMEX:CL.K18.E): 61.93

U.S. Dollar (NYBOT:DX.M18.E): 88.53

Bitcoin (CME:BRTI): 6,194.46

Every Success,

Jeremy Lutz

INO.com and MarketClub.com