OPEC’s Monthly Oil Market Report (MOMR) for April featured an article on the summer petroleum products market. It observed that the U.S. is typically the key driver for products markets in the run-up to the summer driving season, and indicators are pointing to a positive and optimistic outlook.

It cites year-over-year January combined gasoline and diesel growth of 845,000 b/d. It states that the weekly data in February and March further supported this positive trend. And it concludes U.S. gasoline and distillates demand will grow by around a combined 992,000 b/d in 2018.

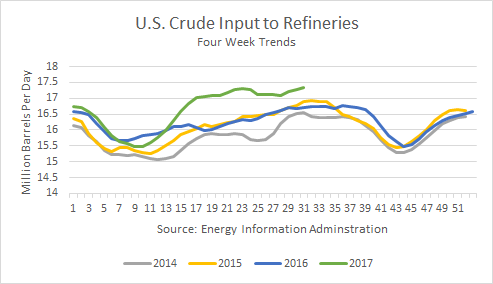

But a closer examination of gasoline demand and consumption estimates provide a different picture. Also, the MOMR totally ignored the supply side of the market, and last summer’s Hurricane Harvey and Mexico’s refinery problems contributed to support that is unlikely to be repeated this summer. Continue reading "2018 U.S. Gasoline Season Outlook"