Analysis originally distributed on March 21, 2018 By: Michael Vodicka of Cannabis Stock Trades

Cannabis testing services is a high-growth cannabis sub-industry.

According to data from cannabis industry media company, High Times, the cannabis lab testing industry was valued at $866MM in 2016.

With more countries legalizing cannabis, demand for testing is expected to soar, with the cannabis testing industry expected to grow to $1.4 billion by 2021.

Today - I am going to reveal a little-known cannabis company cashing in big time from this high-growth sub-industry.

- Sales were up 438% in 12 months.

- It continues to expand in high-growth California.

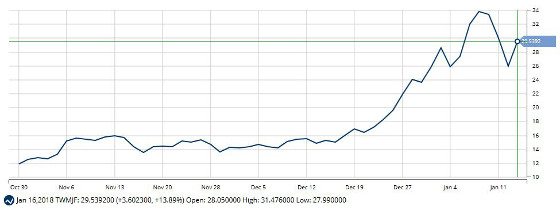

- Shares are trading almost 50% below the 52-week high.

Evio Labs (OTC:EVIO) is a promising young cannabis company headquartered in Oregon with a market cap of $18MM.

I see a lot of growth potential for Evio. Continue reading "Cannabis Testing Company Sales Jump 438%"