Analysis originally distributed on March 1, 2017 By: Michael Vodicka of Cannabis Stock Trades

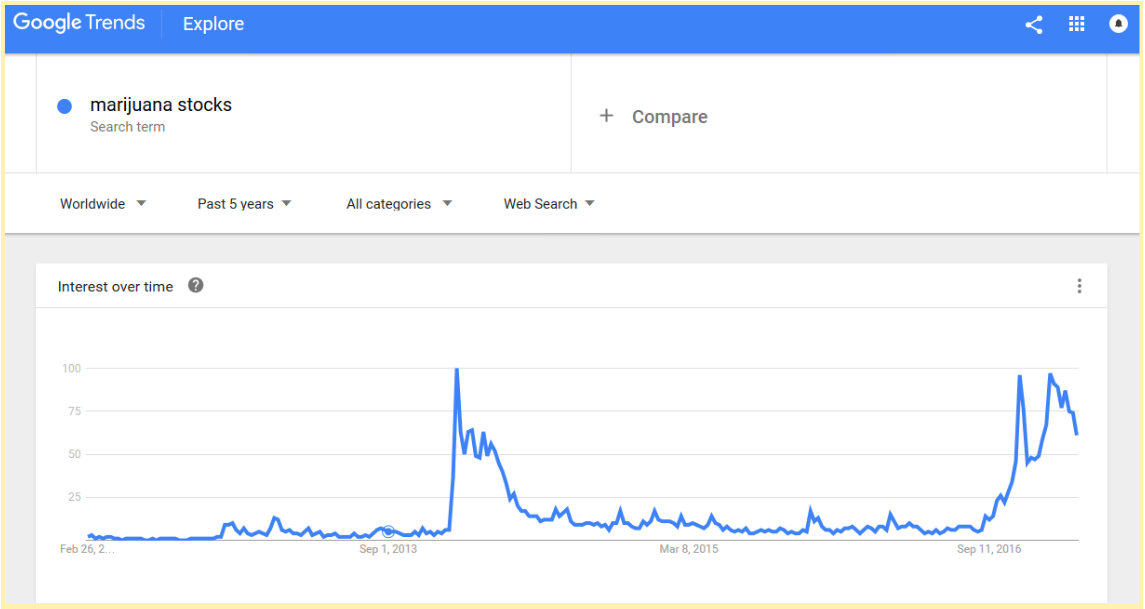

The cannabis industry is more sensitive to political news than other industries. With cannabis still in the early stages of global legalization – when politicians make formal or informal comments about the industry – cannabis stocks respond.

That’s what we saw this weekend.

Last Thursday, White House Press Secretary Sean Spicer was asked about the conflict between state and federal cannabis laws.

The cannabis industry has been eagerly awaiting word on how the Trump administration will handle cannabis. Whatever Spicer said was going to be closely analyzed.

He started by drawing a clear line between medical and recreational cannabis – saying the Feds aren’t even legally allowed to go after medical because of a spending rider approved by congress in 2014 and 2015 that prohibits the use of federal funds to go after state medical cannabis. Continue reading "Trump Admin Nothing For Cannabis Industry To Fear"