Hello MarketClub members everywhere. It's estimated that there will be up to 100 million people watching tonight's debate. Never before have there been that many people so involved and so intrigued by a political debate. Never before has the country been so divided in so many ways.

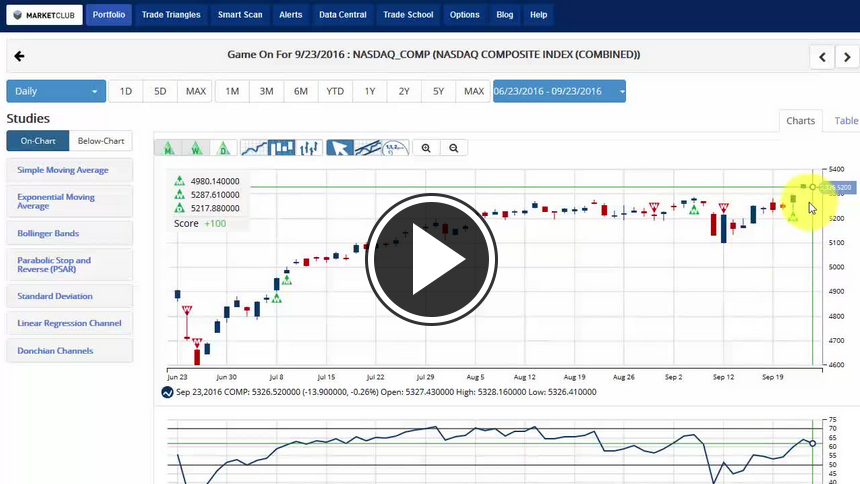

Tonight's debate is going to be historic in the sense that we have never seen two more famous or infamous people depending on your viewpoint duke it out for 90 minutes in prime time. The question is, how are the debates going to affect the markets? That is a question that cannot be answered with any logic. What I do know is that the Trade Triangles will catch any nuances that come out of the debates.

Last week painted a pretty positive picture for most of the markets. Based on the close of business on Friday here are the net percentage changes for the week. Continue reading "Will Tonight's Debate Move The Markets?"