Hello MarketClub members everywhere! Not sure if you live in the rain soaked mid-Atlantic states, but enough already with the rain! It is depressing. The reason I bring this up is the erratic and somewhat depressing action in the stock market.

On Tuesday we watched a massive rally in stocks and everyone was singing happy days are here again. Yesterday, reality and gravity came into the market and took away practically all of Tuesday's gains.

As I said on Monday when I talked about "The Next Big Swing", I believe that the markets are putting in a major top as both the S&P 500 and the NASDAQ have all flashed red weekly Trade Triangles indicating to be out of the market and on the sidelines.

Apple Inc. (NASDAQ:AAPL)

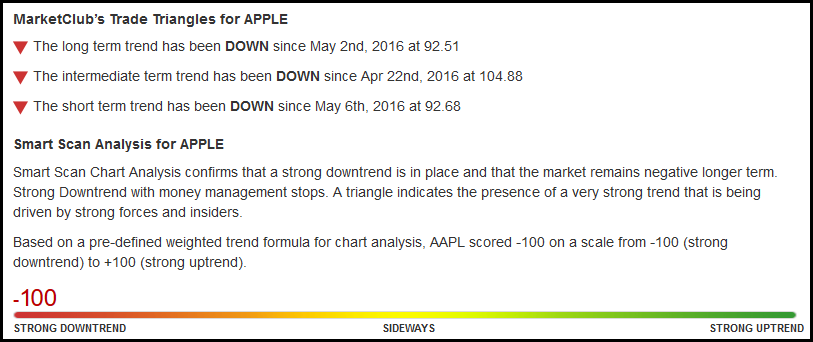

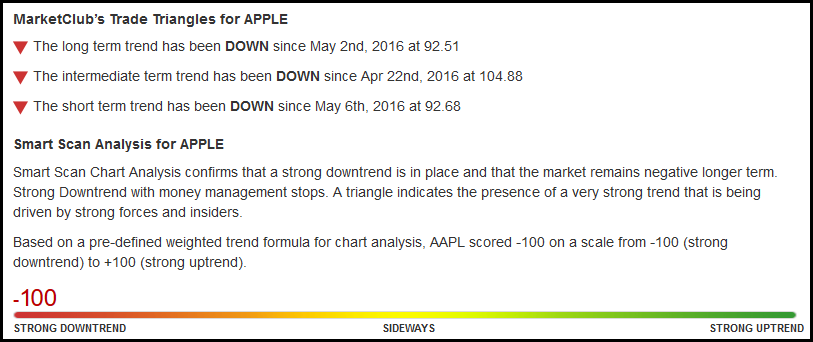

So sad about Apple, here is a stock that was the "apple of every investors' eye" and now this once super stock is now in the dumpster. The question is, with all the Trade Triangles red and pointed lower for Apple, is it just a false signal or is this really the start of a bigger problem? I believe that Apple has some serious hurdles ahead and as the weeks and months pass these problems will come to the forefront.

The biggest problem for Apple right now is that it is not seen as an innovative growth company. Can anyone say "Nokia" and not wonder what happened to this once-leader in the mobile phone market? The next problem Apple has, and this could well be its number one problem, is perception. Apple is just not perceived as a "cool" company anymore. Apple's third problem is expanding its market for its cash cow iPhone. It very much looks like China wants to put the kibosh on any further Apple iPhone sales as they really want to sell their own smart phones (so much for free trade).

The next big psychological level for Apple is $90.00. Once we see around $89, you will see many more investors throw in the towel. On Thursday the 28th of April, Carl Icahn stated on CNBC that he no longer owned any Apple stock. MarketClub's Trade Triangles exited Apple six days earlier at $104.88. I am guessing Mr. Icahn exited around the same time before he made his big announcement on CNBC.

Continue reading "One Of These Markets Is Going Down Big Time" →

What do you think would be the "perfect caption" for this photograph of Senator Bernie Sanders?

What do you think would be the "perfect caption" for this photograph of Senator Bernie Sanders?