The markets will be watching the Fed closely, looking for the central bank's latest decision on interest rates (although no one expects a change), there's also new GDP estimates for the markets to chew on.

Meanwhile, there are corporate earnings to think over, with Apple headlining a week of major earnings announcements. And, the presidential candidates continue to battle for votes and delegates with 5 states up for grabs on Tuesday. With all of that mind, let's take a look at the markets.

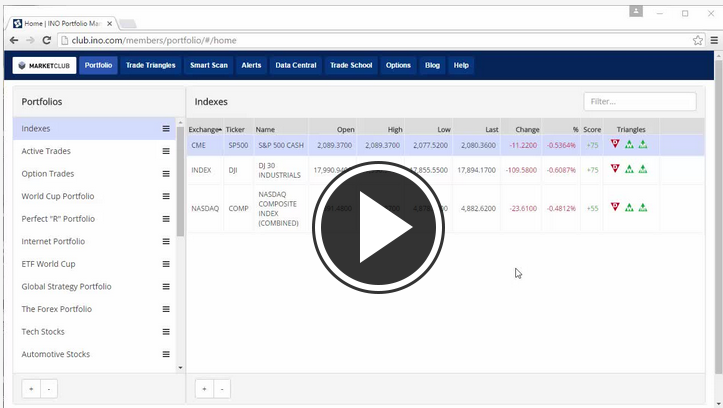

Key levels to watch this week:

S&P 500 (CME:SP500): 2,033.80

Dow (INDEX:DJI): 17,484.23

NASDAQ (NASDAQ:COMP): 4,808.91

Gold (FOREX:XAUUSDO): 1,214.70

Crude Oil (NYMEX:CL.M16.E): 36.57

Every Success,

Jeremy Lutz

INO.com and MarketClub.com

What do you think would be the "perfect caption" for this photograph of Senator Ted Cruz?

What do you think would be the "perfect caption" for this photograph of Senator Ted Cruz?