Let's face it traders, nobody knows where the market is definitely headed next. But using certain market analysis methods we can put the probabilities in our favor to calculate where we should, and probably won't go, next - which is all you need to make money with options.

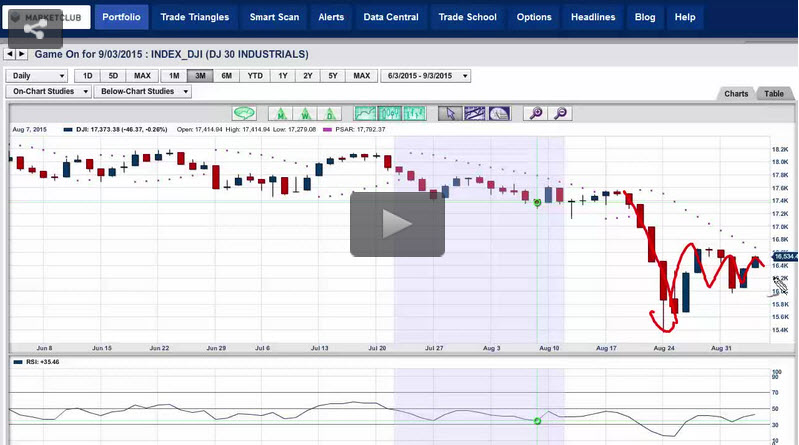

In this video Todd Gordon of TradingAnalysis.com uses the tools of Fibonacci and Elliott Wave to outline the most likely path for the S&P 500 and sets up one options trade in the SPY to profit from two different outlooks in coming weeks.

Learn more about TradingAnalysis.com here.

Plan Your Trade, and Trade Your Plan,

Todd Gordon