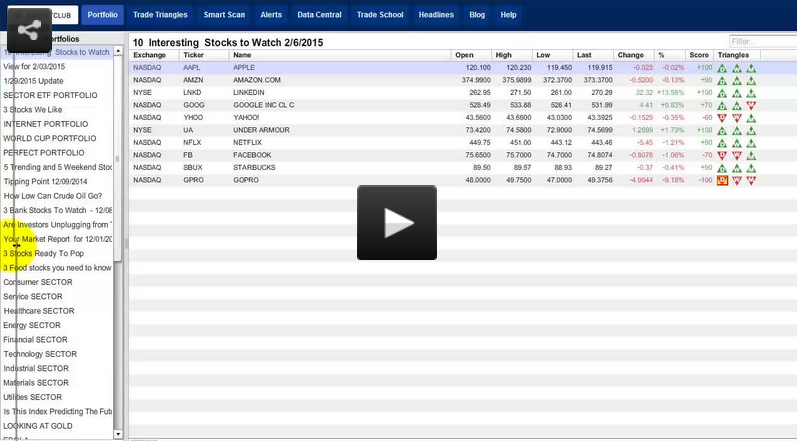

Today I'll be looking at 3 stocks that I believe are uniquely set up to move higher. All of the stocks that I will be looking at in today's video are exhibiting strong internal signals that further compliment the Trade Triangle technology.

In today's, I will share with you exact entry points, upside target objectives and the technical picture for each stock. I'm pretty sure that you have heard of all of the stocks that I'm analyzing today. All the stocks are currently trading on the New York Stock Exchange.

The first stock I will be looking at is LifeLock Inc. (NYSE:LOCK) and it's presently trading around the $15.5 mark. Continue reading "3 Stocks That Are Primed To Move Higher"