We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

We’ve asked Michael Seery of SEERYFUTURES.COM to give our INO readers a weekly recap of the Futures market. He has been Senior Analyst for close to 15 years and has extensive knowledge of all of the commodity and option markets.

Michael frequently appears on multiple business networks including Bloomberg news, Fox Business, CNBC Worldwide, CNN Business, and Bloomberg TV. He is also a guest on First Business, which is a national and internationally syndicated business show.

Coffee Futures

Coffee futures in New York hit another contract high last Wednesday at 209.75 before profit taking ensued closing around 198 in the May contract still continuing its bullish momentum closing higher by about 200 points for the trading week. The chart structure in coffee has finally improved to a point where you can actually put a realistic stop loss as the new 10 day low is at 181.50 and if your still long this market that is where I’m recommending to place your stop loss which is still about 20 points away equaling around $7,500 per contract. Continue reading "Weekly Futures Recap With Mike Seery"

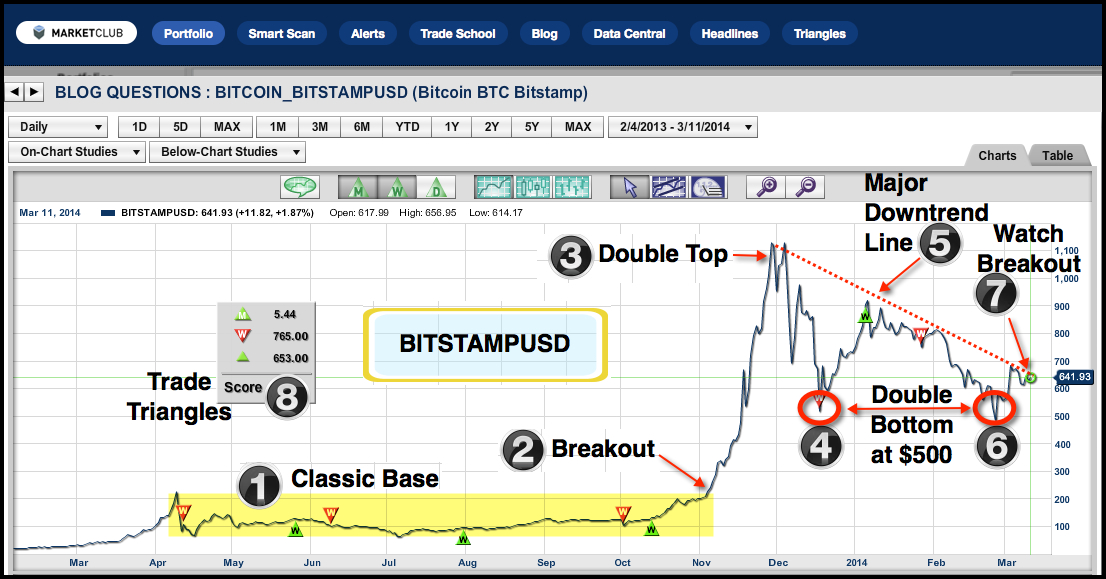

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your