Everywhere you turn, you see stories and videos about another Ebola outbreak. Major epidemics like the Ebola virus often create trends in healthcare, which can lead to major opportunities for investors.

Here is one stock that has been off the radar for most Wall Street firms, but is my favorite Ebola-related stock right now.

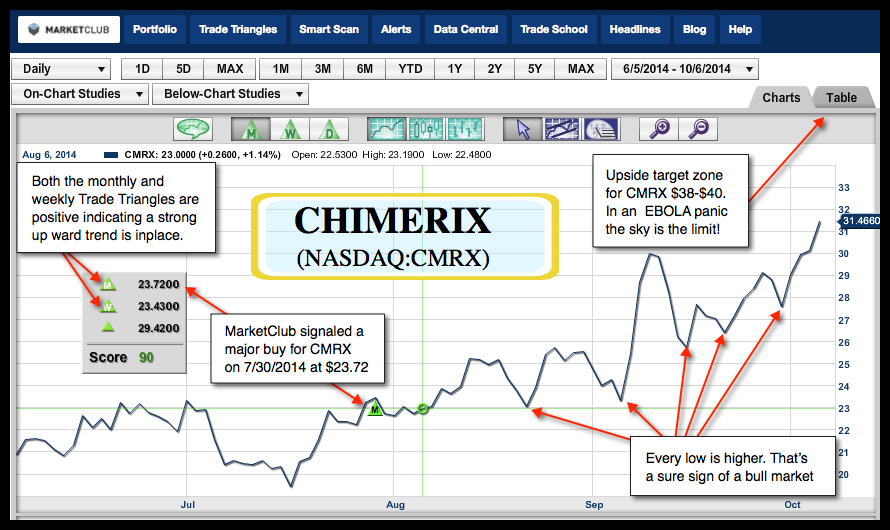

On July 30th of this year, this stock flashed a buy signal based on our Trade Triangle Technology - that was two and a half months ago! Do you remember seeing or reading about Ebola two and a half months ago? I expect not, as the Ebola virus was not front page news like it is now.

Chimerix To The Rescue

The chart below perfectly illustrates the upward trend of this stock. The green monthly Trade Triangle on the chart is where we were first alerted to the beginning of a bull trend for Chimerix, Inc. (NASDAQ:CMRX) on July 30th at $27.32.

Chimerix, Inc. (NASDAQ:CMRX) could have a great deal more room to go on the upside as a result of the Ebola pandemic. I do expect to see volatility in CMRX increase as it climbs a "wall of worry" from current levels. The more news that comes out about the spread or containment of the Ebola virus, the more volatility we could see. Overall, I do believe the trend for CMRX is on the upside and will remain that way for quite sometime. Always protect your capital with solid money management stops. Continue reading "Will Ebola Have A Lasting Effect On The Markets?"